大融合–DeFi的制度化

DeFi对CeFi的侵袭

尽管加密货币市场不景气,但DeFi的制度化正在取得进展。但是,将DeFi概念应用于具有中央管理的CeFi系统是否是正确的做法?无论答案如何,将DeFi协议应用于CeFi可以帮助其创新。DeFi的制度化是由主要的国际金融机构和资产管理公司推动的,但也有得到监管机构和行业协会支持的精品规模的公司。

一个典型的例子是私人市场资产的巨大潜力。为零售投资者开放非传统资产的另类投资平台,将对零售和机构投资产生变革性的影响。

Index

创新者的困境–以一种意想不到的方式进行颠覆?

正如创新技术的出现经常出现的情况,那些表现出来的技术并不符合发明者的期望。蒂姆-伯纳斯-李对这种观察有发言权,例如,Web3和区块链,他希望人们忘记这一点,因为夸张的版本没有达到他的Web3.0项目 让互联网回到最初承诺的目标。

同样的情况也发生在去中心化金融(DeFi)上。去中心化的概念并不新鲜,但在2008年金融危机后,特别是在2015年以太坊协议发布后,获得了突出的地位。DeFi现在被广泛接受为金融业的下一个重大演变。

去中心化金融的先驱者可能会想,机构投资者、中央银行、监管机构和集中式公用事业机构对DeFi概念的采用,对市场参与者来说是一种救赎还是一种警醒。对许多人来说,将DeFi概念纳入中央监管的TradFi生态系统,听起来一定是个矛盾的说法。这正是

这与发明者的想法正好相反,他们的愿景是创建一个替代的、分散的金融系统,而不需要中央银行和政策制定者自上而下的错误治理和控制。

尽管如此,DeFi仍有许多机会,通过帮助发展代币经济和创新集中式金融(CeFi),为所有利益相关者创造积极影响。

DeFi的去中心化性质

近年来,DeFi已经成为一个复杂的生态系统,分布在基础设施服务、协议、各个部门、监管技术和新颖的合同,以及支持不同交付和服务模式的资产类型。虽然加密货币、NFT和Metaverse的市场在今年大部分时间内基本转为低迷,但传统金融(TradFi)的机构支持者继续宣布和推出加密货币和数字资产领域的新服务。

DeFi的机构化是由主要的国际金融机构和资产管理公司,以及由监管机构和行业协会支持的精品公司推动的。

众多的研究可以证明中央银行和银行在国际清算银行创新中心、欧洲中央银行(ECB)和其他倡议的保护伞下实施的势头、实验和试点项目越来越好。

下面的例子令人印象深刻地说明了分散式方法对CeFi的入侵。

- Project Mariana . SNB与BIS创新中心、法国银行和新加坡金融管理局(MAS)一起,正在探索使用DeFi协议的自动做市商(AMMs),用于假设的瑞士法郎、欧元和新加坡元批发CBDC的跨境交换和结算。

- Project Orchid . 新加坡金融管理局(MAS)正在探索使用专门的数字新加坡元(SGD)和所需的支持性基础设施的可能性。 1

- Guardian Project. 作为与新加坡金融管理局(MAS)的合作举措,市场参与者正在测试资产代币化和DeFi应用的可行性,同时管理金融稳定和完整性的风险。 2

- The mBridge project . 香港金融管理局、泰国银行、中国人民银行和阿拉伯联合酋长国中央银行进行了一个试点,支持使用CBDC的实时、点对点、跨境支付和外汇交易。

- Project Icebreaker . 以色列、挪威和瑞典的中央银行正在与国际清算银行合作,探索用于国际支付的零售CBDC。

- Project Cedar . 纽约联储已经完成了一项实验(第一阶段),重点是CBDC是否有可能成为大规模外汇交易的可行选择。 3

- Commercial Bank Money Token (CBMT). 德意志银行在其他三家德国大银行的支持下,正在推广一种CBMT,它应该具有与古典纸币相同的属性,并像视线存款一样受到存款保险的保护,同时,例如,使公司、机器和小数额的支付之间的可编程交易成为可能。

- 首次发行双重上市的数字债券. 瑞银发行了首只在传统的SIX证券交易所和数字资产交易所SIX数字交易所(SDX)上市并公开交易的数字债券。SDX ).

- 总部位于英国的Abrdn是一家管理超过5亿英镑的资产管理公司,最近投资了位于伦敦的受监管数字平台Archax。

虽然是实验性的,但这些项目表明,基于区块链的分布式账本用于(跨境)支付、数字资产的发行和结算可以更快、同步、更安全、更低风险。分布式账本系统设计可以实现数字货币的支付和数字资产的结算,它是24/7/365的基础。各种金融和公共机构(包括中央银行和私人银行)的独立、同质化的账本网络之间的互操作性,显示了一体化数字经济的潜力。

我们现在来谈谈私人市场资产数字化的潜力。

私人市场资产–数字资产的最大潜力?

根据BCG ,在2021年,资产管理行业超过了>100万亿美元的管理资产(AuM)大关。区块链团队的Jonny Fry在他2021年的博文中认为,这代表了数字资产的巨大机会。

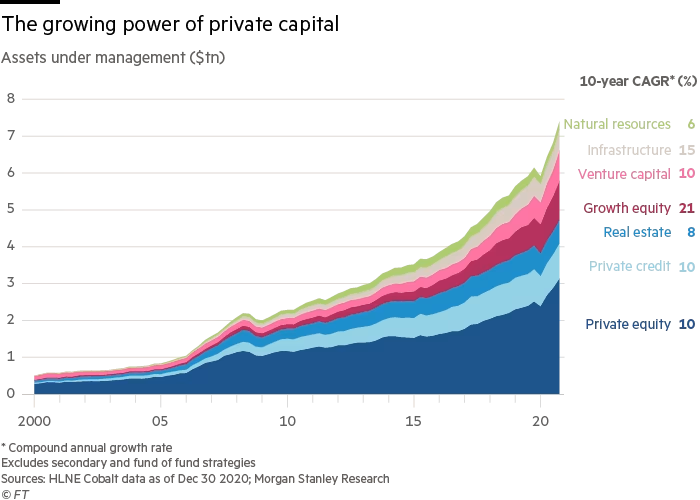

一个有趣的投资领域是快速增长的私人市场资产类别,就其性质而言,这是一个长期和相对不流动的资产类别。这些所谓的另类资产大多是通过无数的文书工作和人工流程来发行和管理的,需要时间和精力,涉及许多利益相关者。

下面的信息图显示了私人市场资产(管理的资产)的情况

流入这些市场的资金证明,尽管有无尽的不确定性,但当投资者有理由相信他们有可能获得相对积极的回报时,他们准备并愿意将资本部署到风险资产。 4

下一大波投资者可能会来自富裕的零售人群,随着私人市场的扩大,他们在很大程度上保持了观望。去年,美国劳工部发文支持在固定缴费计划中进行私募股权投资,个人可以挑选自己的基金,替代性投资的民主化更接近了。

加密货币行业通过发行并使原生加密货币和非加密代币可在集中式和分散式交易所交易,为其铺平了道路。但在2021年的炒作和大型市场参与者的崩溃之后,我们正处于一个艰难的时期,一些交易所的交易量下降了90%以上。有趣的是,这并没有阻止金融资产代币化的相当缓慢但稳定的进展。与大多数具有投机性质的加密资产相比,数字资产在现有和新发行的资产方面显示出巨大和不断增长的潜力。

资产管理行业开始理解数字化的好处,并向投资者提供数字基金。基础基金保持不变,但以数字包的形式提供。这些新的数字基金能够实现更大的透明度,更强的风险管理和合规控制,并使一些基金能够出售给新的投资者。在被各种新的数字交易所报价的同时,数字基金也为现有的证券交易所提供了一个巨大的市场。

在B2C-金融科技的热潮褪去后,专业领域中以投资者为中心的财富科技正在起飞。这种数字平台的趋势得到了私人市场资产日益普及和需求的支持。正如美世的2022年全球财富管理投资调查报告中指出的。

“私人资产的代币化可以显示出好处,并导致更高的采用率,而没有原生加密资产和加密货币的监管不确定性。” (翻译自英文)

Titanbay、Petiole资产管理公司等平台,以及GenTwo、Vestr、Stableton和Swisspeers等财富技术和金融技术公司,表明对数字发行、结构化和分销平台的需求日益增长,这些平台可以很容易地整合到当前的咨询流程和分销渠道中。 5

DeFi遇到CeFi是一个矛盾的说法吗?

在CeFi系统中采用DeFi概念,中央管理的方向是否正确?无论答案如何,将DeFi协议应用于CeFi可以帮助其创新。在现有巨大的资产基础上拓展新的技术和方法,将有助于(重新)创建一个坚实而有弹性的金融市场基础设施。

“在我们建设明天的金融市场基础设施时,我们需要保持警惕。不是所有闪亮的新东西都比TradFi好。设计仍然重要;我们既需要新的也需要旧的。将会有一个融合的时代.” Olaf Ransome (翻译)

现实情况是,我们将继续生活在一个异质的世界里,未来还有许多系统共存。真正的DeFi是一个现实吗?只有时间会告诉我们。

脚注:

- This is not a CBDC, but a privately issued “purpose money” (PBM), i.e. money programmed by smart contracts on a distributed ledger (DLT), e.g. government payments and vouchers.

- See more in Oliver Wyman’s paper ” Institutional DeFi “, 2022.

- The experiment brought clearing and settlement down from the current average of 2 days to under 15 seconds.

- Mercer, 2022: Private markets – Top considerations for 2022

- CB Insights, Future of Investing Report , 2022

Comments are closed.