The Great Convergence ‒ The Institutionalisation of DeFi

The encroachment of DeFi into CeFi

The institutionalisation of DeFi is progressing despite the depressed crypto markets. But is adopting DeFi concepts to CeFi systems with central governance the right approach? Regardless of the answer, applying DeFi-protocols to CeFi can help to innovate it. The institutionalisation of DeFi is driven by major international financial institutions and asset managers but also boutique size firms supported by regulators and industry associations.

A case in point is the huge potential in private market assets. Alternative investing platforms that open access to non-traditional assets for retail investors will have a transformative impact on both retail and institutional investing.

Index

The innovator’s dilemma ‒ disruption in an unexpected way?

As is often the case with the advent of innovative technologies, manifesting those doesn’t meet the inventor’s expectations. Tim Berners-Lee has a say in this observation, e.g., with Web3 and blockchain, which he wants people to forget about as the hyped-up versions do not fulfill his Web 3.0 project’s goal of bringing the internet back to its original promise.

The same is happening with decentralized finance (DeFi). Decentralized concepts are not new but gained prominence after the financial crisis in 2008 and especially after the release of the Ethereum protocol in 2015. DeFi is now widely accepted as the next significant evolution in finance.

The pioneers in decentralized finance might wonder if adopting DeFi concepts by institutional investors, central banks, regulators, and centralized utilities is a salvation or an awakening for the market participants. To many, integrating DeFi-concepts into the centrally regulated TradFi ecosystem must sound like an oxymoron. This is quite the opposite of

the inventors’ idea who had the vision to create an alternative and decentralized financial system without the flawed top-down governance and control by central banks and policymakers.

Nonetheless, there are many opportunities for DeFi to create a positive impact for all stakeholders by helping to develop token-based economies and innovate centralized finance (CeFi).

The decentralized of DeFi

DeFi became a complex ecosystem spread across infrastructure services, protocols, various sectors, regulatory technology, and novel contract, and asset types supporting different delivery and service models in recent years. While the markets in cryptocurrencies, NFTs, and the Metaverse became primarily depressed during most of this year, the institutional proponents in traditional finance (TradFi) continued to announce and roll out new services in the crypto and digital assets space.

The institutionalization of DeFi is driven by major international financial institutions and asset managers and boutique-size firms supported by regulators and industry associations.

Numerous studies can demonstrate the increasing momentum, experiments, and pilot projects implemented by central banks and banks under the umbrella of the BIS Innovation Hub, the European Central Bank (ECB), and other initiatives.

The following examples impressively illustrate the encroachment of decentralized approaches into CeFi:

- Project Mariana: The SNB, together with the BIS Innovation Hub, the Banque de France, and the Monetary Authority of Singapore (MAS), are using DeFi protocols to explore automated market makers (AMM) for the cross-border exchange and settlement of hypothetical Swiss Franc, Euro and Singapore Dollar wholesale CBDCs.

- Project Orchid: The Monetary Authority of Singapore (MAS) is exploring the potential uses of a purpose-bound digital Singapore dollar (SGD) and the supporting infrastructure required.1

- Project Guardian: A collaborative initiative with the Monetary Authority of Singapore (MAS) and market participants are testing the feasibility of applications in asset tokenization and DeFi while managing risks to financial stability and integrity.2

- Project mBridge: The Hong Kong Monetary Authority, Bank of Thailand, People’s Bank of China, and the Central Bank of the UAE ran a pilot to support real-time, peer-to-peer, cross-border payments and foreign exchange transactions using CBDCs.

- Project Icebreaker: The central banks of Israel, Norway, and Sweden are teaming up with the BIS to explore retail CBDC for international payments.

- Project Cedar: The New York Fed has completed an experiment (phase 1) focusing on the potential for CBDCs to become viable options for sizeable foreign currency transactions.3

- Commercial Bank Money Token (CBMT): DZ Bank, supported by three other large German banks, is propagating a CBMT which should have the same properties as classic book money and be subject to deposit insurance as a sight deposit and at the same time, for example, enable programmable transactions between companies, machines, and micro-payments.

- First dual listed digital bond issue: UBS issued the first digital bond listed and publicly tradable on the classic SIX stock exchange, and the digital assets exchange SIX Digital Exchange (SDX).

- UK’s Abrdn, an asset management firm that manages over £500 million, has recently invested in the London based regulated digital platform Archax.

Despite the experimental status, the projects show that blockchain-based (cross-border) payments, issuance, and settlement of digital assets on a distributed ledger can be faster, simultaneous, and safer with lower risks. A distributed ledger system design enables payments of digital currencies and the settlement of digital assets on a 24/7/365 basis. Interoperability across separate, homogeneous ledger networks of various financial and public institutions, including central and private banks, shows the potential for an integrated digital economy.

Now let’s look at the potential of digitalizing private market assets.

Private market assets ‒ the largest potential for digital assets?

In 2021 the Asset Management industry surpassed the >$100 trillion assets under management (AuM) mark, according to BCG. This represents a massive opportunity for digital assets, believes Jonny Fry from Team Blockchain in his blog post from 2021.

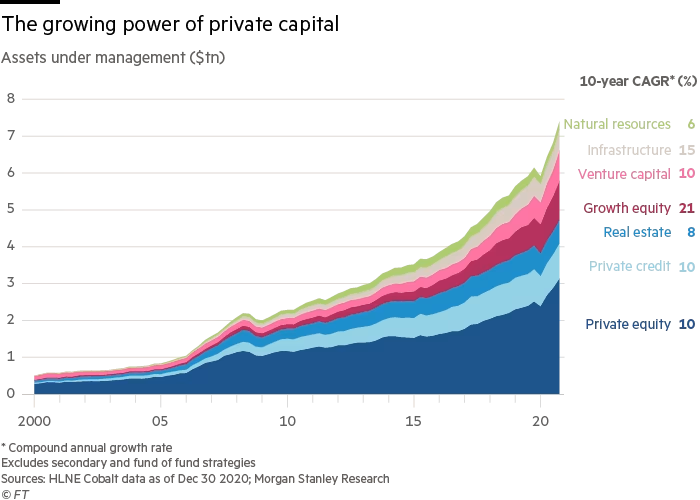

An interesting investment area is the fast-growing volume of private market assets, which are by nature a long-term and relatively illiquid asset class. These so-called alternative assets are mostly issued and administered by myriad paperwork and manual processes, which take time and effort with many stakeholders involved.

The following Infographic shows the Private market assets (assets under management)

The capital inflows to these markets offer evidence that, despite the unrelenting uncertainty, investors are ready and willing to deploy capital into risky assets when they can reasonably believe they may receive a relatively positive return.4 Until recently, the investors were institutional, high-net-worth individuals and family offices. The next big wave of investors will likely come from the affluent retail segment, who have largely remained on the sidelines as private markets have expanded. The democratisation of alternative investments came closer to materialising last year, after the U.S. Department of Labor issued a letter in support of private equity investments in defined contribution plans, where individuals can pick their own funds.

The crypto industry paved the way by issuing and making native crypto and non-fungible tokens tradeable on centralised and decentralised exchanges. But after the hype in 2021 and the collapse of large market players, we are in dire times in which trading volumes are down for some exchanges by more than 90%. Interestingly, this hasn’t stopped the rather slow but steady progress of tokenising financial assets. Digital assets show a large and growing potential in terms of already existing and newly issued assets compared to crypto assets which are mostly of speculative nature.

The asset management industry is beginning to understand the benefits of digitalisation and is offering digital funds to investors. The underlying funds remain the same but are made available in a digital wrapper. These new digital funds enable greater transparency, stronger risk management and compliance controls as well as enabling some funds to be sold to new investors. Whilst being quoted on a variety of new digital exchanges, digital funds also offer a huge market for existing stock exchanges.

After the B2C-Fintech boom fizzled, WealthTechs in the professional space with a focus on professional investors are taking off. The increasing popularity and demand for private markets assets support this trend for digital platforms. As pointed out by the Mercer 2022 Global Wealth Management Investment Survey:

“The tokenization of private assets can prove its benefits and lead to a higher adoption rate without the regulatory uncertainty of native crypto assets and cryptocurrencies.”

Alternative investing platforms that open access to non-traditional assets like private equity, real estate, art, and crypto for retail investors and their advisors will have a transformative impact on both retail and institutional investing.5 Platforms such as Titanbay, Petiole Asset Management as well as WealthTech and FinTech firms such as GenTwo, Vestr, Stableton and Swisspeers show the growing demand for digital issuing, structuring and distribution platforms which can be easily integrated into the current advisory processes and distribution channels.

Is DeFi meeting CeFi an oxymoron?

Is adopting DeFi concepts to CeFi systems with central governance going in the right direction? Regardless of the answer, applying DeFi-protocols to CeFi can help to innovate it. Scaling new technologies and approaches on the basis of the gigantic volume of existing assets will help (re)create a solid and resilient financial market infrastructure.

“As we build tomorrow’s financial market infrastructure, we need to be vigilant. Not everything new that is shiny is better than TradFi. Design still matters; we need both the new and the old. There will be an era of convergence.” Olaf Ransome

The reality is that we will continue to live in a heterogeneous world with even more coexisting systems in the future. Is true DeFi realistic? Only time can tell.

Footnotes:

- This is not CBDC but privately issued “purpose-bound money” (PBM), i.e. programmable money by smart contracts on a distributed ledger (DLT), e.g., government payouts and vouchers.

- More in the paper “Institutional DeFi” by Oliver Wyman, 2022.

- The experiment brought clearing and settlement down from the current average of 2 days to under 15 seconds

- Mercer, 2022: Private markets – Top considerations for 2022

- CB Insights, Future of Investing Report, 2022

Comments are closed.