Decentralized Finance (DeFi) – high potential with new rules of the game

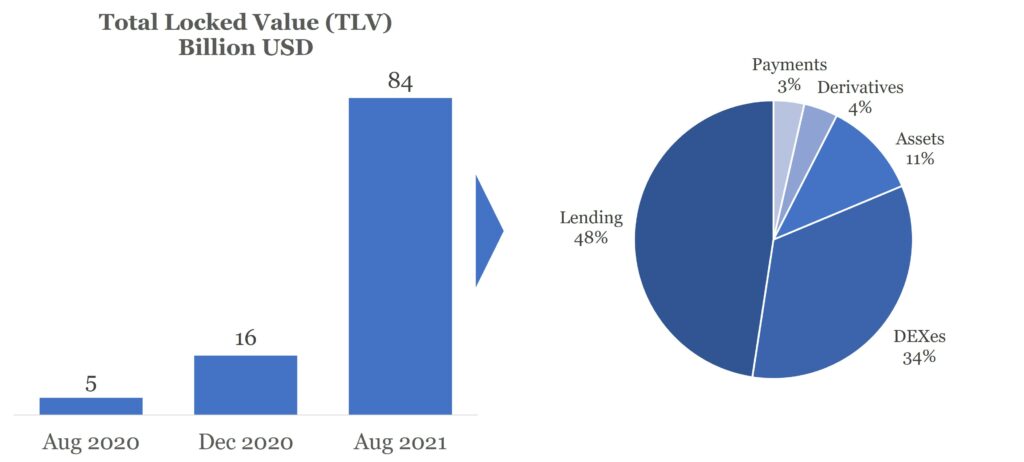

Exponential DeFi growth increases Total Value Locked (TVL) to over 80 billion

The transformation in the financial industry is progressing. Disruptive technologies, increased transparency, lack of trust in central instances, high speed and changing customer needs are important drivers of digital transformation. Cryptocurrencies and digital assets are coming into play as innovations. These enable financial services to be used in a decentralized manner across the globe via the internet and blockchain technology. The original use case is Bitcoin, which enables peer-to-peer (P2P) payments. The next stage of expansion is referred to as Decentralized Finance (DeFi). DeFi has the potential to change the world and enable 1.7 billion unbanked people to access finance.

Index

Definition of Decentralized Finance – In short “DeFi”

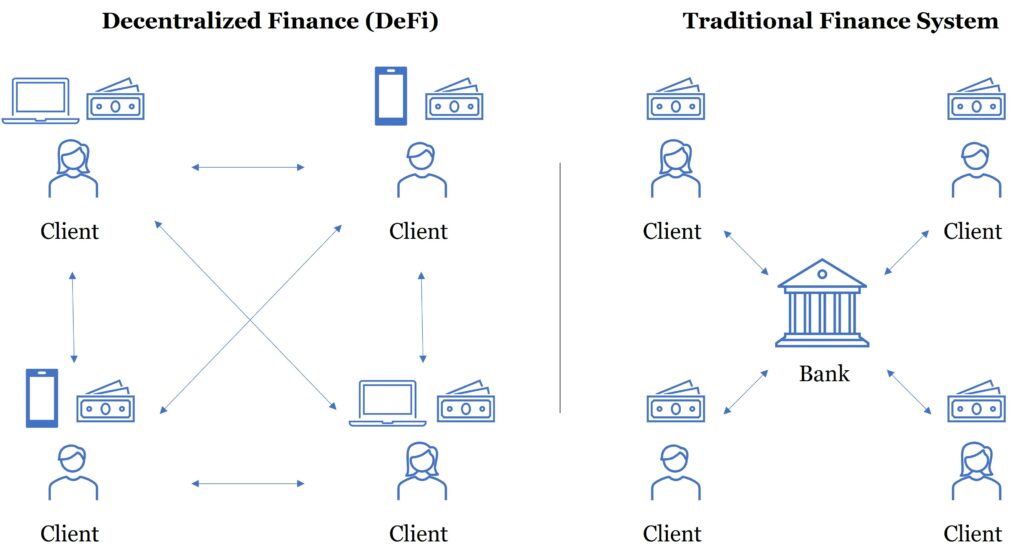

DeFi stands for Decentralized Finance. It is a complete open source ecosystem that offers financial services such as loans, trading, asset management and payments. Dependence on centralized entities is minimized and open to everyone. Interactions are peer-to-peer with smart contracts mainly through the Ethereum blockchain. Ethereum, unlike Bitcoin, is programmable and provides a marketplace for many applications.

Comparison DeFi versus traditional financial system

Tabular overview of the differences.

„Total Value Locked“ (TVL)

The “Total Value Locked (TVL)” is the most common metric to measure the volume of the decentralized financial industry (DeFi). TVL has been rising sharply in recent months, reaching over USD 80 billion in August 2021. The largest DeFi categories are Lending with nearly 50% and DEXes (Decentralized Exchanges) with a 34% share. (Source: DefiPulse)

DeFi applications

DeFi applications and projects fall into five categories. The system continues to evolve and new applications such as insurance, digital identities or compliance are added.

| DeFi Category | Description | Projects |

| Lending/Borrowing | The biggest share in DeFi applications is in lending and borrowing cryptocurrencies. Lending is an interesting way to generate passive income. The owner deposits his tokens and receives attractively high interest as a countertrade. | |

| DEXes | The well-known central crypto exchanges are Coinbase, Binance or Kraken. Coinbase conducted an IPO in April and currently has a market value of over USD 60 billion. With decentralized exchanges (DEXes), trading takes place directly between buyers and sellers through their wallets without a central authority. This dynamic allows for instantaneous trading at a lower cost, which is conducted exclusively via crypto tokens against other crypto tokens. | |

| Assets | In the traditional financial system, assets are held in custody through intermediaries. DeFi Asset Management is a fast growing sector and allows users to manage their own assets (purchases, sales, transfers). DeFi Asset Management offers new opportunities for investors, fund managers or portfolio managers. | |

| Derivatives | In classical finance, a derivative is a contract between two or more parties. The price performance is linked to a specific asset. Ethereum allows an infinite variety of derivatives to be created and hedged via smart contracts without the need for intermediaries. This allows to sell (short) securities on the blockchain like Bitcoin or Tesla. | |

| Payments | The advantages of DeFi are perfectly suited to solve the problems of the current global payment systems. Bank accounts are mostly kept in a fiat currency (CHF, USD, EUR). The disadvantages are high costs and the time required for the sender and recipient to make cross-border payments. Peer-to-peer DeFi payments are more transparent, faster and cheaper. |

Decentralized Finance (DeFi) – Advantages

- Access to financial services for everyone and from any location

- Availability 7 days a week, 24 hours a day

- Lower costs due to elimination of intermediaries

- High returns

- Investments in very small amounts

- Full transparency (open source) on the blockchain by viewing the transaction

- Reduction of human errors due to manual processes

- Innovation of new financial services

Decentralized Finance (DeFi) – Disadvantages

- Hacker attacks make the DeFi system vulnerable

- DeFi credit transactions require collateral of 100%, which limits the circle

- Loss of private wallet key (no recovery)

- Regulation and consumer protection are still in their infancy

- High fluctuation of assets

Implications for banks

The rapid development of Decentralized Finance (DeFi) has major implications for banks. How can DeFi be used as an opportunity for banks?

1. Offer of cryptocurrencies

The market capitalization of all cryptocurrencies has reached the incredible level of currently 2 trillion USD (as of August 2021). Bitcoin is still the dominant cryptocurrency with a total volume of over 900 billion USD. Many customers want to safely deposit their crypto assets with their bank and do trading. This customer need is not possible at most banks today. Swiss banks are having a hard time with cryptocurrencies. The reasons for the hesitation are the increased volatility of the currencies, lack of know-how or uncertain regulatory requirements. As example: First movers in Switzerland include neobanks SEBA, Sygnum or the innovative institution BBVA. BBVA Switzerland offers Bitcoin trading and custody services as well as investments in alternative digital assets.

2. Help shape regulation

Many regulators and central banks are intensively dealing with the topic of cryptocurrencies. The CBDCTracker website shows the current status of developments for CBDC (Central Bank Digital Currencies). Advanced pilot tests are underway in France, China and Canada.

Incumbent banks have the opportunity to play an active role in determining future regulation through new technologies. Banks could collaborate with DeFi providers and regulators in this effort. In this way, they can develop new innovative offerings in the spirit of “co-creation” and help shape the necessary regulations.

The culture of the compliance department should change from a risk-oriented approach to one that encourages innovation. Developers, designers, product and compliance people work together in a complementary way and drive innovation along the guidelines.

3. Build bridges

The Coinbase company pioneered how DeFi cooperates with the traditional financial system. On this platform, cryptocurrencies and traditional fiat currencies (USD, EUR) can be traded. Coinbase’s profits exploded in the first half of 2020 as mass adoption of cryptocurrencies continues.

Incumbent banks could take a cue from Coinbase and offer more crypto services in this new financial system. In particular, tech-savvy and risk-averse customers continue to drive demand. Great potential in the future lies in particular with private investors. These are increasingly interested in cryptocurrencies and have already set up crypto test accounts with small amounts. Crypto asset management mandates, ETFs, funds, structured products or lending are interesting services.

Conclusion

Decentralized Finance (DeFi) is capable of fundamentally changing the financial system. Blockchain technology and DeFi make the system more trustworthy, cost-effective and transparent. Unbanked people gain access to the economic system and new opportunities open up for investors.

It remains exciting to see how traditional providers will respond. DeFi brings opportunities to generate new revenue streams and position itself as an innovative institution in the New World. Investments in new technologies, staff training, and customer services will pay dividends for traditional providers.

DeFi’s future prospects are promising and adoption will continue to grow. Still, there will be setbacks, as in the case of hacking attacks on Poly Network (Source). Regulators are lagging behind the rapid development. The DeFi sector should bring the regulator along for the ride and help shape regulatory requirements. This protects consumers, promotes innovation, and creates a safer financial system.

Comments are closed.