What is FinTech, InsurTech and HealthTech? – Explanation and basics

The digital transformation of the financial services industry and its explanation

FinTech, InsurTech and HealthTech are buzzwords in the digital transformation of the banking and insurance sector. What lies behind them? And when did digitalization actually begin?

Digitization and financial services are my passion. With digital transformation, both come together. Perfect!

In my first post today, I’d like to start by explaining a few terms and distinguishing them from one another. In addition, I will trace the origins of digitalization a little bit.

Index

When digitization actually began

The first (mechanical) calculating machines in the 19th century were a logical consequence of the industrial revolution. The forerunners of today’s computers were created because the need for fast and extensive calculations increased dramatically. The equally accelerated development in technology and science drove this development forward. This is very remarkable, as telephony and electricity were just beginning to develop at this time.

The latest act of digitization: digital transformation

The start of digitization can therefore be located in the 19th century. Digital transformation is the latest act in the wave of digitization.

Digital transformation is about the fundamental change of an industry and its services through new technological possibilities. This transformation does not only act within an industry. It brings together services from different providers across industries in so-called ecosystems.

The basis of digital transformation is a digital infrastructure. It paves the way for new services (products, services) and can optimize existing processes and products. Companies such as Amazon, Netflix and Uber are often cited as prime examples of digital transformation.

The digital transformation also reaches the financial services industry

This seems natural and logical, as financial products are generally “virtual” products. So what could be more obvious than making these products “digital”?

The financial crisis and the odd mishap in the industry caused a certain amount of dissatisfaction and dwindling trust in the “old” companies. This brought new companies (start-ups) onto the scene. They set out to offer financial services “without detours” and for the benefit of the end customer. The aim was to turn the existing business model of the “top dogs” and the associated market upside down through innovation/technology. There is talk of disruption. Today, it can be observed that most start-ups are more in cooperation mode. They have established companies in mind as customers and want to support them in their digital transformation and not simply replace them.

Of course, digitalization and technologization in the financial sector already existed before. Credit cards, ATMs and online banking are just a few examples. However, the digital transformation is much more far-reaching and far-reaching than these examples.

So what is FinTech, InsurTech and HealthTech?

In the context of digital transformation, we often hear and read about terms such as FinTech and InsurTech. These terms are so-called suitcase words, i.e. words that consist of two words.

The first part usually describes the content area in question. The terms often end with “tech”, whereby this “tech” stands for “technology” or “engineering”. The whole term therefore stands for the technologization of a specific area.

FinTech” refers to the technologization of financial services (“finance” plus “technology”), which usually relate to services from the banking sector. Start-ups that are active in this area are also referred to as “FinTech”. A prominent example of such a “FinTech” is N26, a German direct bank that offers financial services via smartphone. The former start-up now has several million customers and is currently trading at an enterprise value of more than one billion.

Digital and rule-based asset management, known as “robo-advisory”, can also be classified in the “FinTech” sector.

“InsurTech” (“Insurance” plus “Technology”) is the little sister of “FinTech” and refers to the digitalization of everything to do with insurance. “HealthTech”, on the other hand, stands for the digitalization and technologization of healthcare and everything related to it, such as prevention or rehabilitation.

And what comes next?

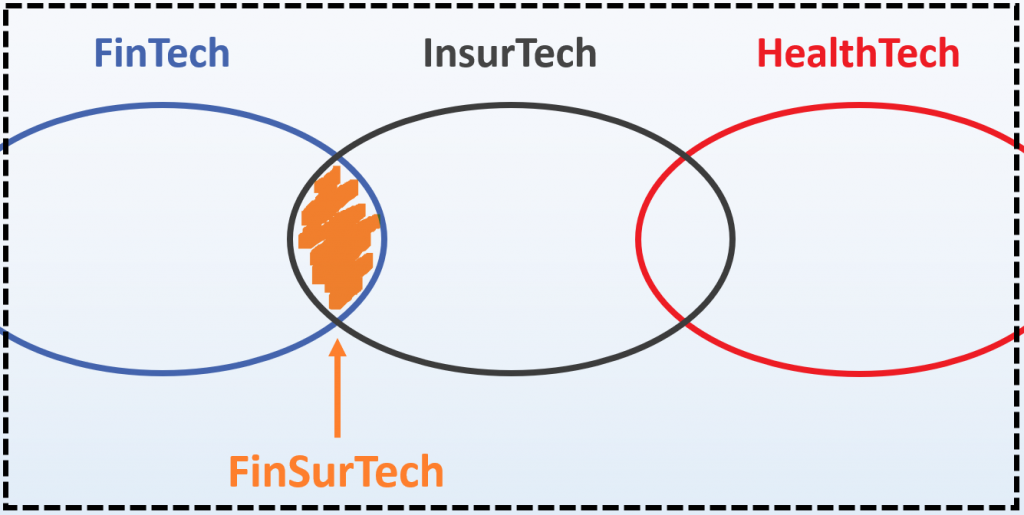

In addition to technologization, digital transformation is also bringing together services from different sectors. Healthcare is an area that a life or health insurer also deals with. In this respect, there is an overlap between “HealthTech” and “InsurTech”.

A life insurer also deals with investment and asset management in retirement provision. Consequently, there is an overlap between “FinTech” and “InsurTech” here.

The merging of services from different providers from different industries gives rise to so-called “ecosystems“. Services from banks and insurers are thus combined in a “finance” ecosystem. Consequently, we will soon have to talk about “FinSurTech” here.

I will deal with “ecosystems” and “FinSurTech” in more detail in my next article!

Comments are closed.