Tokenization – Definition, Challenge and Use of the Token Economy.

Tokenization, a process driving the digitization and simultaneous democratization of the capital market

Tokenization allows virtually any real-world asset to be represented on the Blockchain. By 2027, according to a WEF estimate, 10% of global GDP will be stored on the Blockchain, around USD 9.38 trillion. The central building block for the emergence of a token economy is tokenization. This article describes what it is all about and its partly disruptive significance.

Index

Tokenization – A Buzzword Explained

Virtually any real asset can be mapped on a DLT system through tokenization. According to a WEF estimate, 10% of global GDP will be stored on the blockchain in 2027, around USD 9.38 trillion. Even if these dimensions will not be reached as quickly, it is quite obvious that this and the underlying Blockchain technology will fundamentally change trade and transfer of assets. Hence, the “buzz” is here.

The central building block for a token economy is tokenization. What this is all about and its importance will be described in this article. First, however, we will explain why blockchain technology manages to do what previous digitization methods failed to do and what the effects, benefits and challenges of tokenization are to understand its disruptive potential.

First, let’s take the fuzziness out of the buzzword: tokenization means “creation of a token.” A token in the crypto context is a small piece of software code (smart contract) that represents real value and stores it digitally on a smart contract- / multi-purpose-blockchain, the most popular being Ethereum.

“Tokenization is the process of digitally embedding an asset such as a good or a right into a (crypto) token and storing and issuing it on a blockchain network.”

The token thus acts as a store of value for an asset that persists in the real world, [1] and can be traded and transferred along with its ownership rights on the blockchain network. Thereby, a bridge between real-world and digital space is created.

Blockchain – The Foundation for Digital Property

Blockchain technology has produced two breakthrough innovations, setting the stage for tokenization: Preventing “double spending” and enabling distributed trust.

Preventing double spending: By using cryptographic keys to secure token ownership stored on the blockchain, a crypto token, once minted, can be uniquely assigned to its owner. As a kind of digital copy protection, digital ownership is made possible for the first time in the computer age, a characteristic, formative also of the term “Internet of Value.”

Blockchain technology also creates so-called distributed trust. Consensus procedures (e.g., proof of work or proof of stake) allow crypto assets to be exchanged securely via DLT networks (i.e., peer-to-peer) even within an untrusted environment; central actors such as banks or stock exchanges thus become obsolete.

Existing Assets – the Objects of Tokenization

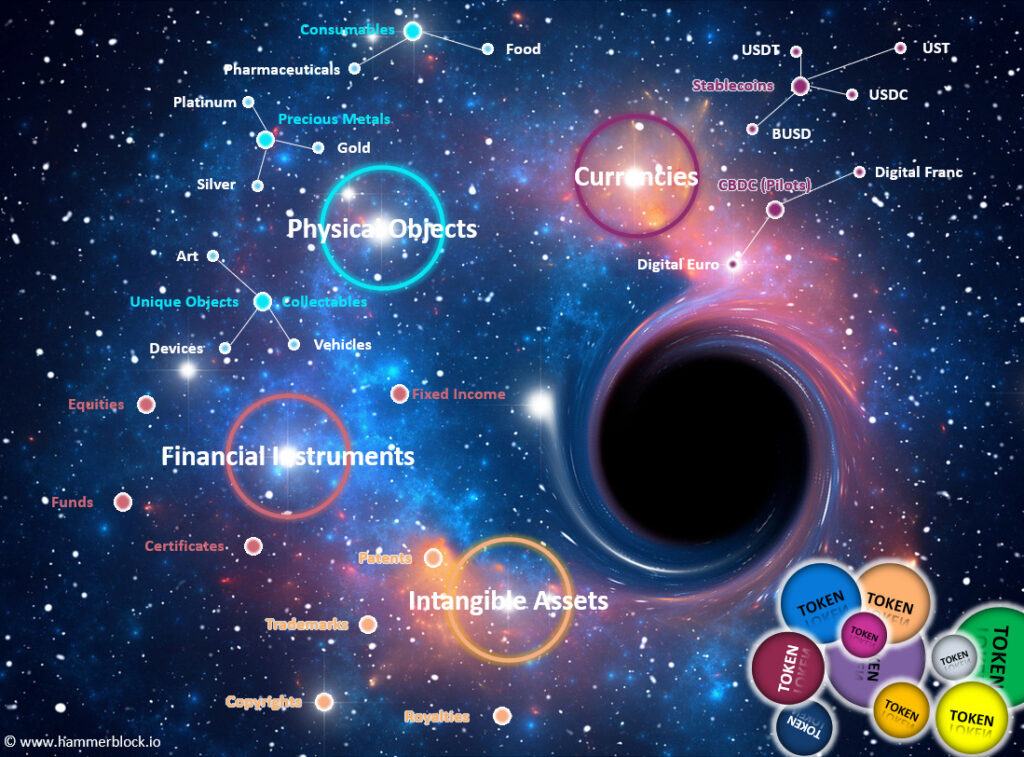

In fact, any asset can be tokenized: fungible financial instruments such as securities (e.g., shares) or physical goods such as precious metals can be tokenized in the same way as intangible goods, e.g., intellectual property and licensing rights, but also fiat currencies as backing for stablecoins. Unique and thus non-fungible assets such as digital or physical works of art can also be mapped and traded in so-called NFTs, which is likely to play a major role in the future, especially in connection with Web 3.0-powered metaverse platforms.

Overview of tokenization objects::

Tokenization – Opportunities, risks and effects

Opportunities and Risks

Tokenization means opportunities and risks. Potentially the biggest threat arises to the existing capital markets industry. The creation and issuance of securities on the blockchain, specifically in the form of equity tokens, could make most of the traditional intermediaries and processes in equity markets redundant. Within DeFi (decentralized financial) industry, hundreds of crypto exchanges have already emerged in recent years, controlled centrally (e.g., Binance or Kraken; CEX overview) or decentrally (e.g., Uniswap; DEX overview). Centralized, decentralized, and hybrid approaches are already blurring, and the digitization of the capital market has thus begun. For incumbent players, this poses what could be an existential threat. For the early adopters among them, however, it can also be an opportunity, leading to first-mover advantages and repositioning in the market of the future, i.e., what has made the DeFi industry tick for a while.

Promises to Business and Society

Tokenization is associated with many promises for industry, customers, and ultimately us, first and foremost efficiency gains, market democratization, and the creation of new markets.

Cost and acceleration effects result 1) from the elimination of central actors such as banks or exchanges, 2) from the elimination of redundant data synchronization processes utilizing the distributed ledgers (“atomic settlement”), and 3) the use of autonomous, smart contract-driven system control.

The democratization effect is also achieved by eliminating central actors, but also by getting around market access restrictions; it is now possible for private companies and start-ups to tokenize company shares at low cost and participate directly in the (decentralized) capital market. This democratizes (capital) market access and simultaneously creates new markets.

However, new market potential arises primarily from the fractionizing of digital assets and additional liquidity generated as a result. Previously illiquid (also “non-bankable”) assets such as private securities, fine arts or real estate can be broken down into the smallest shares (“fractionality”) through tokenization and traded efficiently and around the clock on the secondary market. This should appeal to small investors in particular and create new liquid markets.

Challenges of the Market and its Players

Despite the enormous momentum with which our world is already growing into a token economy, we are only at the beginning and major challenges for society, politics and the economy lie ahead.

In particular, there is a lack of (international) standards in the regulatory and data areas. In regulatory context, one can currently speak of a country-specific patchwork at best. It will take time for reliable regulatory standards to become established. In the data and interoperability area, too, standards have yet to emerge – just think of the migration of the centrally controlled SWIFT standard into decentralized smart contract-based protocols.

The development of an efficient infrastructure and sufficient market liquidity has also only just begun. An infrastructure for issuance and trading of digital assets needs to be partially rebuilt along the known value chain of 1) tokenization (origination and distribution), 2) token trading, and 3) settlement (clearing and settlement) including post-trade services (e.g., token custody). Only with an efficient, user-friendly infrastructure can a liquid market form.

Market maturity is not expected for another 2-5 years.

Token Ecosystems – Emergence of the Token Economy

In order to create a token economy, an efficient tokenization process and an ecosystem that operates it are central in addition to the aforementioned framework conditions. We will now present both and focus on the tokenization of securities, especially shares, into security tokens [2]. These are designed for mass trading in the regulated sector, and thus offer the greatest growth potential. We are guided by the Blockchain Hub Switzerland with its already grown infrastructure and existing DLT legislation.

Security Token Issuance – Decentralized Capital Raising for SMEs & Startups

The tokenization of capital investments in security tokens forms the first step in the value chain of a digital capital market, on which the further steps of trading and post-trading services are built. The latter two are therefore excluded here. Tokenization takes place through Security Token Offerings (STO), a new form of capital raising that is significantly cheaper, more efficient and more direct than IPOs with its many de facto access restrictions. This makes it particularly attractive for start-ups and SMEs.

Structuring and issuing security tokens, however, is by no means trivial; technological, legal, regulatory, tax, financial and business-relevant aspects must be tested and implemented. We pick out the two central ones here, the technical and the regulatory one, and imagine as an example, a medium-sized company that wants to issue part of its shares as security tokens to raise growth capital.

The tokenization process – regulatory and technical aspects

One of the central questions for the structuring of a token is its regulatory qualification and the obligations that may be attached to it. In Switzerland, the regulatory classification of a token is determined by its intended economic function and purpose. In our case, it is about the tokenization of tradable equity shares including voting and dividend subscription rights analogous to a share. Such purpose qualifies as investment tokens and are treated like traditional securities from a regulatory perspective, which means that the corresponding investor protection provisions of Swiss financial market law apply. Among other things, an investment prospectus informing about investment risks must be published and approved by the authorities beforehand. Further regulatory obligations could arise from anti money laundering provisions if the token is also to have a payment function, which is usually not the case.

Apparently, the regulatory classification of a token is central, of strategic importance for its structuring and must therefore be clarified early and comprehensively.

The same applies to the technical side of tokenization. In this respect, shares can be created and issued on the blockchain via STO free of entry barriers and central players, but comprehensive clarifications and operational measures are necessary beforehand:

- Definition of technical standards: Which token standard and which blockchain?

- Modeling of the asset: How should the asset be modeled and what valuation methods should be used?

- Testing and audit: Technical verification of the token and smart contracts on a blockchain test environment, esp. testing and audit.

- Go-live: Activation of the token on the blockchain.

For many token types, technical standards already exist with core functions pre-programmed in the smart contract. For the security token designed for trading securities, this is the ERC-1400.[3] Furthermore, a blockchain network suitable for trading with security tokens must be determined. In addition to general selection criteria such as mass adoption capability and reliability, the primary criterion for Security Tokens is whether the network is capable of mapping the entire lifecycle of a security, including the exercise of voting rights, payment of dividends, and the clearing and settlement. Also, the blockchain should be open to global access, i.e., be a public and access-free one. Ethereum, the most popular and also most successful general-purpose blockchain for STOs, is an obvious choice, but other platforms such as Cardano, Tezos, or smaller ones like NEO or Stellar EOS are now available. In-depth platform knowledge and strategic foresight is therefore also required here.

The software and the smart contract must then be tested on the blockchain and audited before the token can finally go live on the blockchain and be distributed.

Ecosystems – The Basis for Successful Tokenization

In addition to a grown crypto industry including infrastructure providers along the capital market value chain, an army of experts and service providers has now also formed around tokenization in Switzerland. One could almost speak of an independent tokenization ecosystem that has formed as part of the blockchain and crypto hub that has grown out of Zug (Crypto Valley) with its hundreds of blockchain companies.

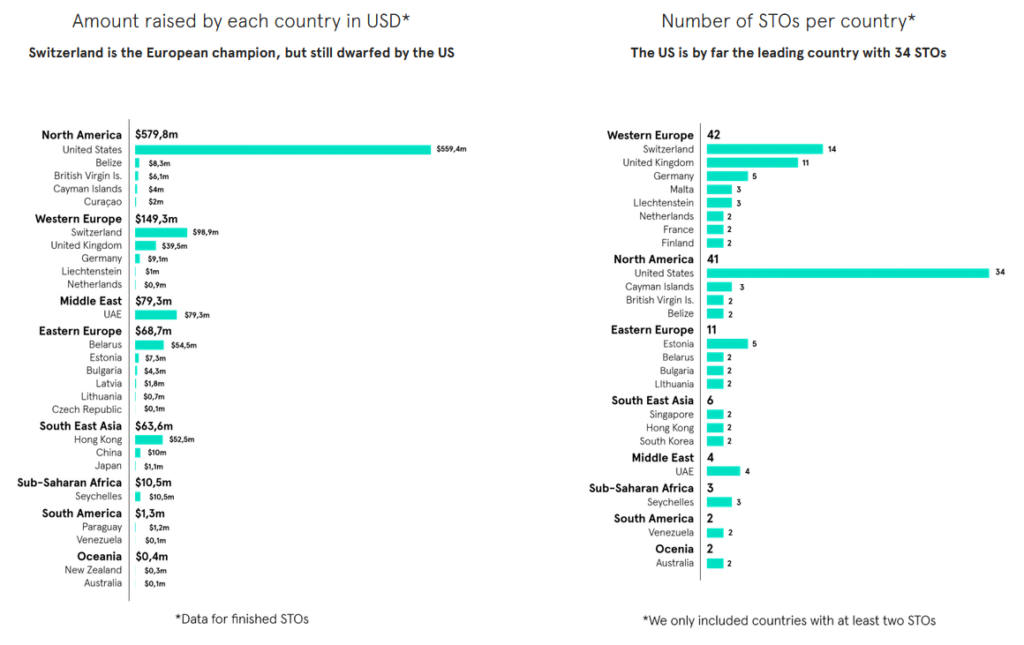

Two key figures in the chart below show the importance that the Swiss market for STOs already played in 2019, surpassed only by the disproportionately larger America:

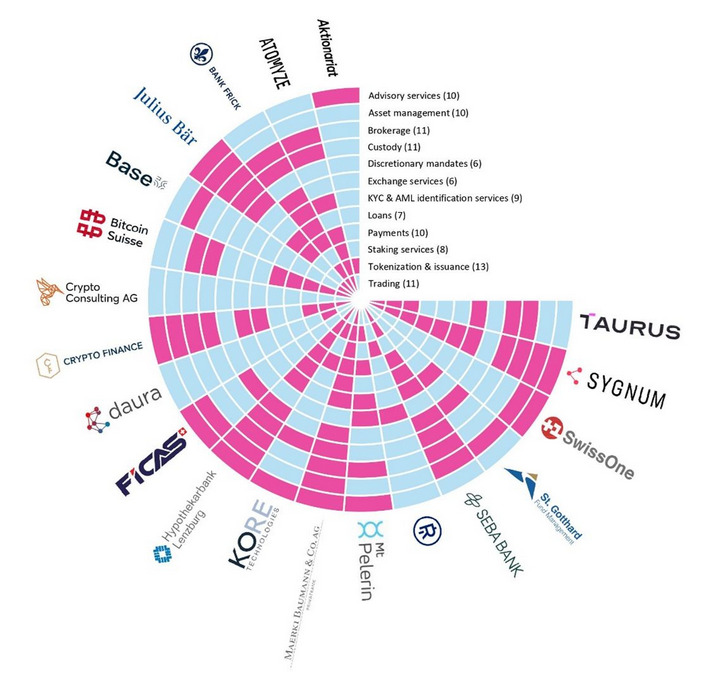

A look at capital markets and financial services for digital assets also reveals a relatively high density of tokenization services across the industry. Thirteen of the 20 selected firms surveyed last year offer tokenization, including some that specialize in tokenizing securities and equities.

Taking Switzerland as an example as a hub for digital assets, it becomes obvious that a token economy is growing and growing fast – provided the necessary framework conditions are in place. One thing is already clear today: The token economy will come, with all its force – for the democratization enthusiasts of the financial market among us probably slower than hoped, but for the traditional representatives of a centralized capital market much faster than they would like.

Sources:

[1] This distinguishes a token from blockchain-inherent currencies with no real-world (“off-chain”) equivalent, such as bitcoin or ether (aka coins / “native” tokens)

[2] Other fungible token types such as payment tokens (e.g., bitcoin), utility tokens, hybrid tokens or stablecoins, and NFTs are not covered here

[3] ERC stands for “Ethereum Request for Comments”. The standard applies across blockchains, so it is interoperable

Comments are closed.