How NFT and Crypto impacts the real economy

Beyond the bubble - How companies can profit from non-fungible tokens (NFTs)

The hype around Non-Fungible Tokens (NFTs) continues. While many haven’t even heard of it or dismiss it as the next hype in the crypto bubble, others are talking about a breakthrough in connecting the physical with the digital world. The article explains why this may actually be the case.

The hype around non-fungible tokens (NFTs) still continues. Even though it is mainly happening within the crypto bubble, a closer look reveals a huge potential for the real economy. NFTs will open up new types of marketplaces and digital ecosystems unlike anything we have seen today. Therefore, it is good to understand the potential and then draw possible business conclusions from it.

Index

What is NFT?

What exactly are NFTs? First of all, NFTs are cryptographic tokens, just like the already well-known examples Bitcoin, Ether (ETH) and countless others. Tokens like Bitcoin belong to the “fungible tokens.” This means there are a lot of similar tokens that are interchangeable. No matter which Bitcoin I own, the value is always the same. In contrast, NFTs are unique and thus not interchangeable – each token has an individual characteristic. For this reason, NFTs are suitable for representing digital goods such as works of art or music, and also physical goods such as land, machines or cars. In essence, then, an NFT binds a unique physical or digital object to a unique digital token. Because of the secured uniqueness and standardization of these tokens, they can now be used in digital business processes. For example, NFTs can be used within digital ecosystems to declare ownership rights for physical goods and make them tradable.

Characteristics of an NFT

In my view, NFTs become interesting in particular because of the following properties:

1. Assured uniqueness

Assuring the uniqueness of an object is already not easy in the physical world and presents us with even greater challenges in the digital world. NFTs can permanently ensure the uniqueness of a digital object via the underlying blockchain technology.

2. Tamperproof

Equally, directly linked to the blockchain is the tamper-proof nature of the NFT. This property is essential for trusting business relationships in the digital space.

3. Standardization

In order to integrate an object into business processes and make it exchangeable between all partners in an ecosystem, it is necessary to standardize the description of these. NFTs use standards such as ERC721 to create digital ecosystems.

4. Programmability of business processes

Probably the most important difference to conventional digital objects is the combination of NFTs with logic. This is made possible by the underlying smart contracts. This is already used in today’s NFTs, for example, to allow the creator to participate in an increase in value in the secondary trade of the work of art. The logic required for this is integrated in the NFT and cannot be changed by subsequent owners due to the aforementioned tamper protection.

Punks, Apes und Whales

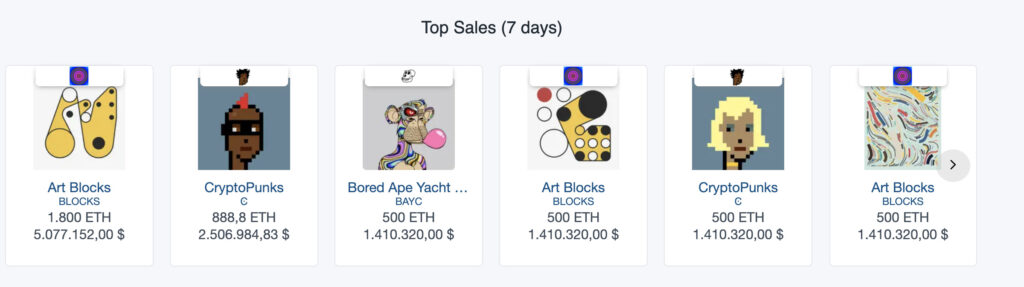

The hype around NFTs has grown extremely in recent months. At the time of writing, the top sale of an NFT was 1,800 ETH, which is equivalent to more than US$4.5 million at the current price.

The story of 12-year-old Benyamin Ahmed who raised US$400,000 with his Weird Wales is also spectacular. There are numerous discussions about the sense and nonsense and the monetary equivalent value of these art NFTs. However, that is not what this article is about. Rather, I would like to advocate not dismissing NFTs as hype of the “crypto scene”, but understanding their possibilities in the context of a native digital economy.

NFTs beyond the hype

So let’s leave the hype behind and look at the possibilities of NFTs for the real economy. What can NFTs be used for there? NFTs offer companies new opportunities to manage and market goods in digital ecosystems. They can bring benefits wherever goods are shared today or exchanged between different partners as part of a joint value creation process.

Let’s look at a few examples:

1. Upselling into the digital world

For consumer goods in particular, presence in the digital world is crucial. Today’s Instagram, TikTok, etc. will in the future be virtual worlds in which companies are present with their products. NFTs can be used to map the virtual counterparts of real products (e.g., sneakers). The owner of a real sneaker thus also has the right to let his avatar wear it.

2. Sharing Economy – Jointly own resources

Companies jointly acquire a machine in order to use it. The acquisition takes place via an NFT-based business marketplace. All companies that have a share in the machine thereby get the right to use it. In a connected SmartContract, the scope of use can be defined depending on the ownership shares. Similarly, this can also automate the billing of usage to finance operating costs. So instead of having a responsible middleman as the owner of the machine, joint ownership of resources is mapped here.

3. New financing options

Combining NFTs with Decentralized Finance (DeFi) results in completely new forms of financing. Real assets such as machines, cars or land can be brought into a digitally native market. The proof of value provided by NFT can be used to tap into forms of financing such as crowdfunding, securing a fundraising, or digital native payments.

So, as we can see, NFT can support business models that connect the analog and digital worlds, as well as help build ecosystems of collaborating partners. Furthermore, in combination with DeFi, new financing options can be opened up that simplify and democratize access to capital, especially for small businesses.

Conclusion

So, as we have seen, NFTs already offer new opportunities, especially for creators, to market their content through digital ecosystems and also to participate in secondary trade in the long term. This addresses weaknesses of an economic system based on centralization and lack of digital capabilities. Blockchain technology as infrastructure and Decentralized Finance for economic exchange are fundamental to this. Participants in an ecosystem can rely on the integrity and uniqueness of NFTs for economic exploitation without having to tie themselves to a centralized intermediary or marketplace operator. Away from art, these principles can be applied to almost all industries that do business with real and digital goods.

Comments are closed.