Ethereum & Co. – General-purpose blockchains are more than just payment systems

How general-purpose blockchains and other powerful smart-contract platforms are taking the market by storm

Bitcoin is blockchain, but blockchain is not Bitcoin. Today, hundreds of standalone blockchain systems exist, the most powerful besides Bitcoin is Ethereum. As the first general-purpose blockchain, it goes far beyond Bitcoin’s readiness for use as a payment system, virtually single-handedly dominating the Defi and NFT markets, for example, and has now even surpassed Bitcoin in terms of the number of users. Benefits of general-purpose blockchains for the economy and society explained.

Index

1. Differences of Blockchain and DLT Projects

Bitcoin is blockchain, but blockchain is not Bitcoin. Bitcoin is commonly equated with blockchain, and rightly so. With its beginnings as a secure (decentralized) peer-to-peer payment system founded on a public blockchain, the cornerstone for both blockchain technology and the cryptocurrency itself was laid in January 2009, heralding its triumphant advance. Today, more than a decade later, hundreds of independent blockchain systems exist alongside Bitcoin.

The most widely used blockchain platform besides Bitcoin is Ethereum. “Ethereum is a global open-source platform for decentralized applications … On Ethereum, you can write code that manages digital assets, runs exactly as programmed, and is accessible from anywhere in the world.”[1]. The network described in Vitalik Buterin’s white paper at the end of 2013 and in operation since July 2015 is the number 2 cryptocurrency worldwide behind Bitcoin in terms of its market capitalization, but already number 1 in terms of the number of users. If one compares the price movements of the corresponding cryptocurrencies, represented by their network-owned tokens BTC and ETH, it is striking that they develop almost in parallel, i.e. correlate, and the assumption suggests itself that investors assess the purpose and benefit of the two different networks in the same way. In the author’s opinion, this is not comprehensible. True, both systems are considered the 2 vanguard blockchain platforms and the 2 top cryptocurrencies. However, as the first so-called general purpose or smart contract blockchain, Ethereum is fundamentally different from Bitcoin as a pure payment system.

This article will highlight the similarities and differences between the two networks and what Ethereum’s additional benefits for the economy, society and ultimately every individual are, which are only gradually becoming apparent. It also explains why this network benefit is reflected as a real value in the Ether token, a view that most traditional economists are not (yet) willing to follow. Since the equally young and complex megatrend blockchain / “crypto” is only just beginning to arrive in society, the opportunity is also taken to explain selected aspects of blockchain technology as a whole.

2. What Bitcoin and Ethereum have in common

Bitcoin is the first digital currency that can be securely transferred in a fully decentralized manner, i.e., in an untrusted environment, between people who are completely unknown to each other. This has created a digital payment system that does not require centralized entities such as banks and payment service providers, so it could actually drive the disintermediation of the financial sector. It promises simplicity, security, speed and lower transaction fees compared to traditional payment systems. Sociopolitical upheavals have also been triggered, as shown by examples from El Salvador, whose government recently introduced Bitcoin as a state alternative currency, or from other countries, especially in the southern hemisphere, which recognize Bitcoin as a payment solution for the population without bank accounts (keyword “bank the unbanked”).

Bitcoin is blockchain: Technically, the Bitcoin blockchain is the public ledger that keeps track of all Bitcoin transactions ever made, chronologically and in blocks. It can be viewed and used by anyone, and is stored and updated decentrally on thousands of computers (hence DLT for distributed ledger technology) in a peer-to-peer (“P2P”) network. A cryptographic algorithm generates proof that the payment has been made correctly in an elaborate calculation process (so-called proof of work, or “PoW” for short), thus eliminating the risk that a Bitcoin has been spent twice or counterfeited (so-called “double spending”). However, Bitcoin is not only a blockchain-based payment network, but also a means of exchange, a virtual means of payment represented by the BTC token and made tradable via the Bitcoin blockchain.[2]

Like Bitcoin, Ethereum enables the decentralized use of digital money using its own public blockchain, a public key infrastructure, a PoW consensus process and the native token ETH. The aforementioned high correlation between the two market rates is at least understandable so far. However, the possible uses of Ethereum go far beyond those of Bitcoin.

3. Ethereum, the first general purpose blockchain

Ethereum – unlike Bitcoin – is a blockchain platform programmable via smart contracts,[3] through which decentralized computing applications known as “dApps” are created. It was “conceived as a shared global infrastructure, … and is ideally suited as a foundation for a wide range of financial and non-financial protocols…”[4] It can be used to represent ownership of property and move digital assets, but also to build applications of any kind in which data cannot be stolen or censored, in short:

Ethereum basically created a decentralized blockchain operating system for the secure transport of trusted information that is available and usable by everyone worldwide.

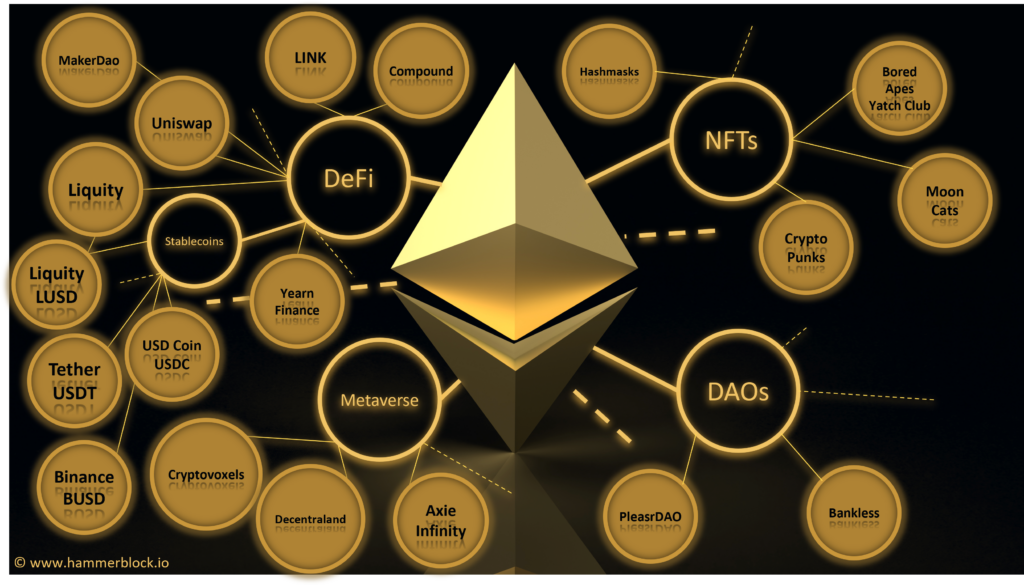

Ethereum is thus the first general-purpose blockchain, which highlights the following scheme:

DeFi (decentralized finance) stands for financial applications of fungible, i.e. exchangeable, value, NFTs (non-fungible tokens) for semi-financial applications, and DAOs (decentralized autonomous organizations) for non-financial applications that get by with only limited human interference, such as online voting or decentralized governance.

Let’s pick two examples that describe the versatility of the Ethereum platform, one from the Defi, the other from the NFT universe, and both from Switzerland, home of the Ethereum Foundation and known as a blockchain nation with a corresponding ecosystem and reliable blockchain legislation.

Example – DeFi

DeFi describes an ecosystem that provides crypto-based financial services such as lending, trading, asset management, and payments.[5] The Defi-platform Liquity offers, among other things, loans that are obtained as Liquity-owned stablecoin[6] (LUSD) against collateralization by Ether. This Defi-product is thus comparable to a Lombard loan from a bank, through which a bank customer is provided with short-term funds in exchange for pledging their securities and paying a loan interest rate. In order to become a bank client, the interested party must first meet the Know Your Client (“KYC”) requirements, among others, and in order to obtain a Lombard loan, among other formalities, must conclude a (hand-) written general deed of pledge. She must therefore go through lengthy processes, combined with a cascade of questions and forms, often still in paper form.

As a Defi instrument, the processes run online and without delay. Defi is increasingly regulated, but the KYC requirements are handled quickly online. To obtain the credit line in the form of the stablecoin, all that is required is the posting of ETH as collateral with one of the liquidity providers, simply via crypto wallet and without any further formalities, certainly not handwritten ones. This offers the customer not only efficiency advantages. The Liquity loan is available for a one-time fee of 0.5% completely interest-free (!) – revolutionary in the credit market.

Example – NFT

Now to NFTs and its large creative lab. NFTs represent another market first created by Ethereum. An NFT is a token that embodies a non-exchangeable, unique ownership right regarding an item or a respective claim, and provides proof of authenticity and ownership. This makes an NFT tailor-made for products of creative work.

The same kind of NFTs is used by Hashmask. At the beginning of 2021, this Ethereum project had tokenized an art collection of 16,384 unique digital portraits created by 70 artists on the Ethereum Blockchain and sold them in an online auction in record time. These purely digital art objects can now be traded on OpenSea, a crypto platform specializing in NFT. Unlike prominent predecessor projects such as CryptoPunks and CryptoKitties, Hashmask additionally uses a so-called name change token. This allows the consumer to define the name and thus influence the work itself. It is precisely examples like these that illustrate the unlimited variety of applications that Ethereum as a general-purpose blockchain creates with smart contracts.

4. The value of Ethereum as a general-purpose blockchain for business, society and commerce

The value of Ethereum as a network

What the real utility value of the Ethereum platform consists of has just been hinted at. Simply put, the value of Ethereum comes from the trusted, because verified, information held in the blockchain, the size and growth of the network created by the dApps. As of June 2021, there are already their 3,000. A network between social and economic actors has been created around the Ethereum system – the Ethereum ecosystem – which is constantly growing. Billions have been invested in corresponding ventures. According to DefiPulse, the Defi sector alone had an average of $80 billion in assets invested between July and August 2021:

Already today, the number of transactions of Ether exceeds that of Bitcoin and the development is only at the beginning. The platform’s ability to store and trade almost all information securely and privately in a decentralized manner opens up further markets for trustworthy information. Digital profiles with sensitive personal data, e.g. health data, can be created and made available in a targeted manner. Users could once again be in control of their own data, and there would suddenly be alternatives to powerful central platforms such as Amazon, Microsoft or Facebook.

By creating an entire operating system, Ethereum has set a unique selling point and its own first-mover advantage in the crypto market. However, the networking community must not rest, such advantages can quickly fade in the tech scene; who remembers MySpace, Netscape or Yahoo? Therefore, to remain agile in the market, Ethereum – unlike Bitcoin – has a governance structure with a central development team and can thus initiate protocol upgrades. Blockchain adaptations such as the upcoming switch from the PoW consensus process to Proof of Stake (PoS) are thus just possible and legacy issues can be resolved, respectively making the network more scalable, secure and sustainable.[7].

The value of Ether as token

The Ethereum platform thus creates value through real benefits. Surprisingly, the majority still sees the ETH token itself differently. It is not seen as a real value carrier with intrinsic value. In order for the token to be considered a real asset or crypto-asset, it would have to have the property of a store of value and thus generate either income or real utility. According to the view expressed here, however, this is fulfilled.

Native crypto tokens derive their value from the trustworthy, because verified, information on the blockchain. The minting of the ETH token therefore only creates the prerequisite for making this information fungible, unlockable and tradable. It is therefore difficult to understand how the Ethereum network should have a value, but its coin does not.[8] Thus, according to the opinion expressed here, the value of ETH is derived directly from the utility of the Ethereum network and is thus considered a store of value. Or, to put it another way, the Ether can be seen as a commodity. The token is a carrier of the trustworthy information it contains and is thus itself a commodity with real utility value.[9] In the future, with the introduction of the PoS process and the staking function, Ether will also fulfill the second characteristic as a store of value: Yield / income.

Whether Ethereum can maintain its first-mover advantage remains to be seen. With Polkadot, Solana, Algorand and Cardano, some serious competitors are emerging in the general-purpose blockchain market. Time-to-market will therefore remain paramount for Ethereum.

The biggest risk for crypto assets, including ETH, however, is international regulation.[10] If one listens carefully, a clarifying storm is imminent, starting from the U.S.A. (Europe and China are already further ahead, albeit with opposing measures) and mainly hitting the Defi and stablecoin market. Subsequently, however, the market should be able to develop sustainably.

So, after some rumblings, we can look forward to more breakthrough innovations by Ethereum and its decentralized general-purpose blockchain platform.

Sources

[1] See https://ethereum.org/en/

[2] Bitcoin traces its origins to Satoshi Nakamoto’s white paper published in late 2008: https://bitcoin.org/bitcoin.pdf

[3] More on smart contracts: https://morethandigital.info/en/what-are-smart-contracts-understanding-contracts-on-the-blockchain/

[4] Page 34: https://ethereum.org/en/developers/docs/web2-vs-web3/

[5] More on Defi: https://morethandigital.info/en/defi-decentralized-finance-explained/

[6] More on stablecoins: https://www.coinbase.com/learn/crypto-basics/what-is-a-stablecoin

[7] ETH2 upgrade: https://ethereum.org/en/eth2/vision/

[8] See Jeff Currie, in: https://www.goldmansachs.com/insights/pages/crypto-a-new-asset-class.html

[9] In the U.S., Bitcoin and the Ether (as the only native tokens) qualify as commodities for regulatory purposes, not as securities.

[10] More on crypto regulation: https://morethandigital.info/en/regulations-and-bans-what-threatens-crypto-bitcoin-co/

Comments are closed.