Regulations and bans – What threatens crypto, bitcoin & co.

The continued crypto victory march is not guaranteed

Some say Bitcoin cannot be stopped, others claim it is only a matter of time before it is banned. At the same time, however, it is clear that states have no interest in strong parallel currencies and are under pressure to act. They have a whole arsenal of measures at their disposal for their reaction, which they can bring into position against Bitcoin. The Bitcoin price would correct accordingly.

(by Patrick Schüffel and Markus Hammer) The triumph of Bitcoin is unstoppable – these and similar statements are regularly heard from the supporters of cryptocurrencies. [1] The “digital gold” would inevitably replace state currencies as a store of value.[2] This is often justified with its technical nature as a decentrally organized currency, its already large distribution, and quantitative limitation to 21 million units. At the same time, there are also cautionary voices that expect Bitcoin to be regulated as a digital currency or even see ownership bans on the horizon. But what is actually meant by “the regulation” of the digital currency and what effect could it have on the Bitcoin market? This article explains how multifaceted regulation can be and outlines the arsenal of government intervention options and their potential impact.

In principle, a state has no interest in a parallel currency that exists alongside its state money and over which it has no power to act. On the contrary, if such a parallel currency becomes too popular, the state loses its autonomy over its monetary system. Controlling the economy and the state budget then becomes immensely difficult. To prevent this, the state will try to gain control over this parallel currency through regulation.

Regulation is state intervention in a private action. If one follows the general principles of the rule of law, government measures must have a legal basis, be in the public interest and be proportionate. They must be suitable for achieving the set regulatory goal and fulfill a protective purpose, which has so far been done only vaguely in the case of Bitcoin. Regulation can include bids and requirements, but in a broader sense also prohibitions.

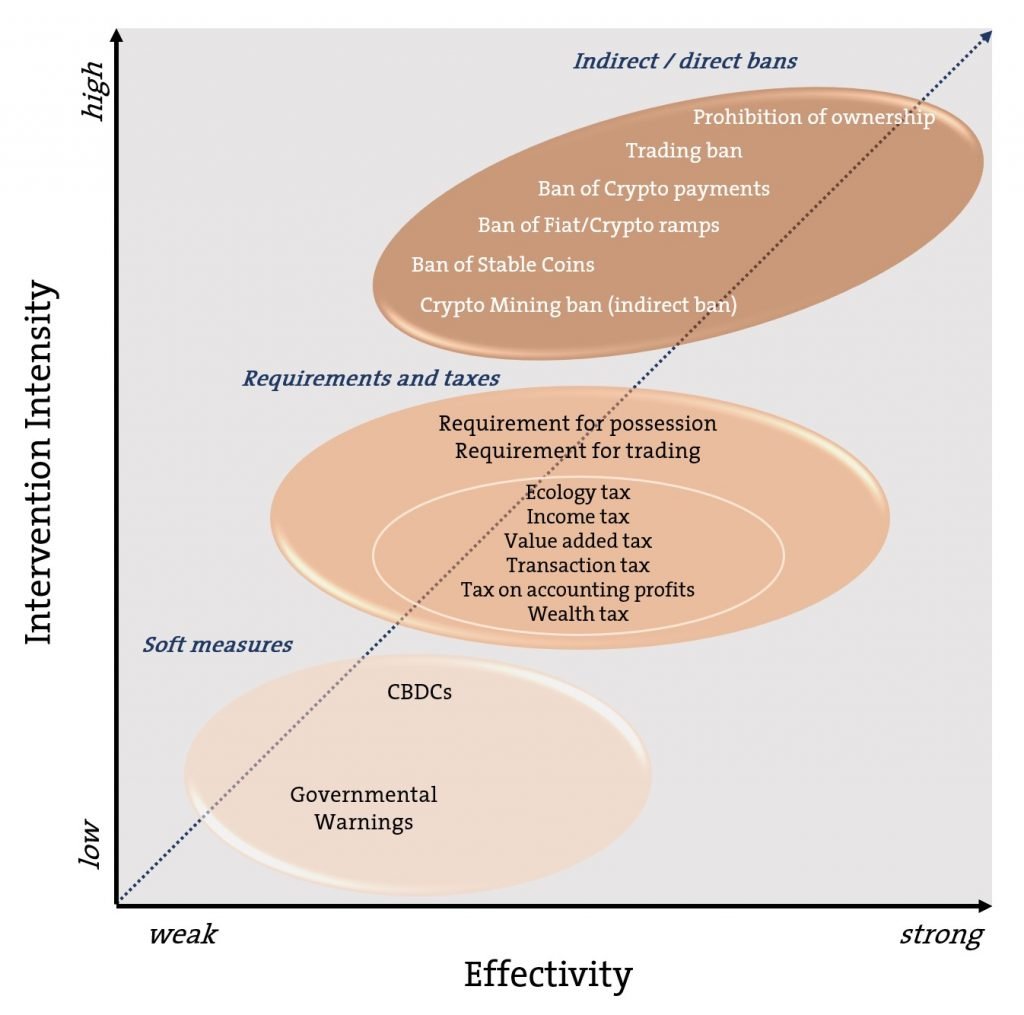

From the perspective of the affected market participants, market intervention can be stronger or weaker, i.e. more or less invasive. The stronger the intervention in private law activities, the higher the requirements for a legal basis. Measures such as government warnings tend to be light interventions, while bans are considered very invasive.

Measures, on the other hand, can have different degrees of effectiveness. Effectiveness here describes the effect of the measure on the Bitcoin market, i.e. on supply and demand. Effectiveness depends on various factors: the type of measure itself, but also the regional scope and the subject of regulation. The latter can, for example, be limited to payment tokens or also include utility, investment, or non-fungible tokens (NFT). Depending on the measure, effectiveness and intervention invasiveness have a different effect on the market and thus the Bitcoin price.

Along with their impact, we have also classified government measures into three groups: Soft measures, bids and taxes, and indirect and direct bans.

Index

Soft measures

We define soft measures as options for action that the state already has today within the framework of existing regulation. For example, it can warn about the risks of the Bitcoin market or – based on its monopoly on coins – introduce its own state cryptocurrency, the so-called Central Bank Digital Currency (CBDC).

1. Government warnings

Bitcoin has always had a questionable reputation, sometimes being called a drug-dealing currency – not entirely unjustifiable. The state has also actively used this narrative regarding the money laundering risk. In the meantime, however, institutional investors are investing in Bitcoin, payment services such as PayPal allow Bitcoin as a means of payment, and large companies such as Axa or Tesla accept Bitcoin payments. Even certain Swiss cantons accept Bitcoin to pay taxes. Government warnings are therefore visibly fizzling out. Governments therefore increasingly justify their warnings with consumer and environmental protection. However, the presumably true reason remains unknown: to prevent capital from fiat currencies into Bitcoin. However, this alone would hardly be sufficient legal justification for a government measure. Recently, U.S. Treasury Secretary Janet Yellen warned against Bitcoin in no uncertain terms. She questioned its legality and function as a store of value and criticized its energy consumption.[3] The warning alone led to an immediate price drop of about 10%.

2. Central Bank Digital Currency

Other soft regulatory measures include CBDCs. These would be in direct competition with private cryptocurrencies and, depending on their form, would even be possible within the framework of current legislation. For example, the Swiss National Bank proposes an e-Franc as a digital 1-to-1 replica of the existing Swiss franc and pure bearer instrument. Whether CBDC would pose serious competition to bitcoin is not yet foreseeable. Certainly, a CBDC would be superior to Bitcoin because of its lack of scalability. On the other hand, Bitcoin is limited in quantity and, as “digital gold,” is more likely to generate trust than digital state fiat money, which would remain multipliable at any time at the push of a button.

Bids and taxes

Bids, as well as taxes, can be used to regulate bitcoin. Both would have an impact on the Bitcoin price.

1. Regulation in the narrower sense

In addition to soft measures, the state has the possibility to intervene in areas that are currently not regulated at all or insufficiently regulated. This does not have to be done by bans, but can also be done by a milder form of regulation through bids. Although Bitcoin & Co. would be subject to state control through bid regulation, at the same time a certain legal and planning certainty would be created for market participants. For example, Germany recently enacted a crypto investment law that allows special funds to invest in crypto assets that are subject to state regulation.[4] This is a possession requirement, but trading bans are also conceivable, such as subjecting Bitcoin trading to money laundering or MIFID regulations.

2. Taxes

Taxes are a popular tool that states sometimes use creatively to finance the national budget or to enact incentive measures. Fiscal measures depend heavily on their regional customs. For example, cryptocurrencies can be treated and taxed as an investment asset (Denmark, Norway, Finland), financial instrument (Germany), intangible asset (Switzerland), property (Singapore, New Zealand), financial asset (Venezuela), commodity (Canada)[5]. In addition to the definition of the tax object, aspects such as the type of tax or the area of a value chain must also be determined.

As a wealth tax, a levy could refer to the entire wealth or explicitly only to Bitcoin as a digital asset, and an introduction could lead to disposals of Bitcoin on a larger scale and a corresponding price loss. The situation would be similar for a book profits tax, which would be levied on unrealized book profits. Analogous to a financial transaction tax or the Swiss stamp tax on securities, a transaction tax could be levied on Bitcoin trading, which would make the corresponding trade more expensive and markets more illiquid. It would also be a good idea to levy a value-added tax on the purchase and sale of Bitcoin, for example. Israel taxes newly mined Bitcoins, while other countries have explicitly exempted the purchase and sale of Bitcoins from VAT (e.g. Ireland, Switzerland, EU). Alternatively, the fee for mining cryptocurrencies could be subject to income tax, as is the case in the U.K., Japan, or Luxembourg.[6] An interesting tax variant would ultimately be an eco-tax on Bitcoin. Given the enormous energy consumption for the consensus process (proof of work) for Bitcoin, the revenues could be tied up and used for ecological purposes while at the same time generating a steering effect.

Indirect and direct prohibitions

The most invasive form of state intervention is prohibition. According to the principle of proportionality, it should only be the last resort. However, we cannot go into whether the principle is observed in this article. We must limit ourselves to providing an overview of the state’s arsenal of prohibitions. This is arranged according to the intensity and effect of the intervention.

1. Bitcoin mining ban (indirect ban)

The region “Inner Mongolia” in the north of China, which is currently responsible for about 8% of Bitcoin mining (for comparison the US: about 7%) recently announced to ban Bitcoin mining soon because of its high CO2 emissions.[7] The ban will hardly affect the Bitcoin market. It is more likely that mining will shift to other provinces and – should the ban be extended within China – to other countries such as Russia, Malaysia, or Myanmar. One thing to keep in mind here is that the Bitcoin network is based on decentralization. If it comes to its extremely strong concentration of mining activities due to state regulation, this could bring Bitcoin down.

In addition to this indirect ban, states have a whole range of ban options aimed directly at Bitcoin, as there are:

2. Prohibition of the creation of stable coins

Stable coins are tokens that are firmly linked to assets and aim to achieve relative price stability. They are therefore very close to state currencies. The most prominent stable coin project was the Facebook digital currency Libra (now Diem), which in its original form and because of its potential to influence U.S. monetary policy, was buried by the American regulator before it was even born. China has also already been active and has legally banned the creation of stable coins based on the Chinese yuan.[8] Stable coins are among the cryptocurrencies with the highest turnover. If they were to be banned across the board, it would be a significant setback for the crypto world, as stable coins are used as a medium of exchange and a measure of value, especially in Bitcoin trading. Without them, liquidity on Bitcoin markets would be significantly reduced.

3. Ban on fiat / “Crypto Ramps”.

Crypto Ramps describe the interface between state currencies and the crypto world. If an end-user wants to buy cryptocurrencies, they must exchange state currency for crypto or exchange it back into state currency when selling. If this interface, which is mostly manned by payment service providers, were to disappear, the flow between state currencies and Bitcoin would come to a standstill.

4. Trade ban

What “crypto ramp” bans are to payment service providers, Bitcoin trading bans would be to crypto exchanges. These exchanges would be de facto banned, significantly weakening Bitcoin’s liquidity; Bitcoin could no longer be exchanged for other crypto or government currencies. The South Korean financial regulator has already been very specific about this in late April.[9]

5. Ban on bitcoin as a means of payment

A ban could apply to Bitcoin and other cryptocurrencies as a means of payment and already established payment examples such as the aforementioned PayPal, Axa or taxes would be capped again from one day to the next. This would result in a significant, and probably long-term, price collapse. A ban limited to Bitcoin as a means of payment was just enacted in Turkey[10] and resulted in a Bitcoin dive of 4%. It may not be the last example.[11]

6. Possession ban

Within the prohibition category, as the most severe form of state intervention, the ban on Bitcoin ownership would again be the most invasive measure. Practically every activity around Bitcoin would be legally prevented. Historically, there are already models for this, such as the gold ban of 1933 in the U.S.[12] Algeria already enacted a corresponding one on digital currency, including Bitcoin, in 2017.[13] It may be doubted that a general ban on possession would stand up to constitutional principles, especially the principle of proportionality. Indeed, all of the officially stated protective purposes can also be achieved by less invasive measures.

Conclusion on possible regulations

We have shown that the Bitcoin market can be strongly influenced by government intervention. The impact depends on the type of measure, the object of regulation, and the geographic scope. Further, we have pointed out that the most obvious regulatory reason is to guide government monetary policy, regardless of other ostensibly stated protective purposes. With every day that passes without bitcoin regulation, states will lose a measure of autonomy over their monetary systems. We are therefore convinced that increased Bitcoin regulation will happen soon. This could happen in individual countries or across countries.

For countries that follow rule-of-law principles, we consider bid regulations to be the most likely. These are likely to be used for cryptocurrencies, which are used as a means of payment. Consumer and money laundering protection are likely to serve regulatory purposes. Apart from clearly defined individual measures, bans will remain the exception; the legal foundation would be too shaky. We rule out a ban on possession altogether.

But even if we limit ourselves to a proportionate bid regulation and create certain regulatory transparency, the effect on Bitcoin & Co. will be significant and sustainable: The use of Bitcoin as it is possible today would be restricted and the price would consequently fall sharply, as the example of Turkey has already shown.

On the other hand, a watertight Bitcoin regulation forms a Herculean task: Numerous fallback options exist for crypto investors. A clear demarcation between token types is difficult. Collateral damage to already established ecosystems such as smart contract applications around Ethereum and thus also to the real economy would have to be accepted. Given the competition among states, it is likely that crypto regulation will remain a patchwork. It will probably take years to achieve a certain degree of harmonization.

Ultimately, even the best regulation will not solve the fundamental problem that is currently driving investors into the arms of Bitcoin: the loss of confidence in arbitrarily multipliable government fiat (in the future also CBDC) money. If this fundamental problem is not solved, governments will also have to think about how to stop the flight to non-digital alternative currencies such as gold or silver.

Sources

[1] https://unchained-capital.com/blog/bitcoin-cannot-be-banned/

[2] https://economictimes.indiatimes.com/markets/commodities/news/novogratz-says-bitcoin-is-digital-gold-not-a-currency-for-now/articleshow/78842371.cms

[3] https://www.cnbc.com/2021/02/22/yellen-sounds-warning-about-extremely-inefficient-bitcoin.html

[4] https://coinjournal-net.cdn.ampproject.org/c/s/coinjournal.net/news/germany-allows-institutional-funds-to-invest-in-cryptos/amp/

[5] S. Report for Congress, LL File No. 2021-019649, January 2021: https://www.loc.gov/law/help/cryptocurrency/block-rewards/comp-sum.php

[6] https://www.oecd.org/tax/tax-policy/taxing-virtual-currencies-an-overview-of-tax-treatments-and-emerging-tax-policy-issues.pdf

[7] https://www.cnbc.com/2021/03/02/china-bitcoin-mining-hub-to-shut-down-cryptocurrency-projects.html

[8] https://www.finews.asia/finance/33025-china-proposes-ban-on-yuan-linked-stablecoins

[9] https://www.coindesk.com/south-koreas-top-financial-regulator-suggests-all-crypto-exchanges-could-be-shut-down

[10] https://www.indiatoday.in/technology/news/story/turkey-bans-bitcoin-and-other-crypto-coins-for-payments-will-india-follow-1791719-2021-04-16

[11] https://www.reuters.com/technology/turkey-bans-use-cryptocurrencies-payments-sends-bitcoin-down-2021-04-16/

[12] https://economictimes.indiatimes.com/markets/commodities/news/novogratz-says-bitcoin-is-digital-gold-not-a-currency-for-now/articleshow/78842371.cms

[13] https://www.loc.gov/law/help/cryptocurrency/cryptocurrency-world-survey.pdf

Authors: Patrick Schüffel and Markus Hammer

Comments are closed.