Cryptoassets: Intrinsic Value Matters

Value investing in cryptoassets - How do I separate the wheat from the chaff, or scam from substance?

Today, “crypto” is hardly understood as an investment instrument. Crypto is obviously not crypto, and the positions on what is valid sometimes diverge diametrically, even between proven authorities. This leads to great uncertainty among experts, and even more so among the general public. This article aims to shed some light through the fog onto crypto and help distinguish crypto-scam from crypto-value. It will show which cryptoassets and crypto tokens have intrinsic value and how this could be measured in the future using fundamental value analysis methods. The two largest and oldest cryptos, BTC (of the Bitcoin network) and ETH (of the Ethereum network), serve as reference points and examples.

Index

1. Cryptoassets: Light and shade

“A cryptocurrency is not a currency, not a commodity, and not a security, … It’s a gambling contract with a nearly 100% edge for the house” It’s “crazy, stupid, gambling,” and “people who oppose my position are idiots”, so Charlie Munger in February 2023.[1]

This cryptocurrency is “… misunderstood …”. It can provide “an insurance policy against financiel disaster,…” because it is “not connected to the rest of the financial system,” so Bill Miller about Bitcoin in October 2022.[2]

These contrasting positions roughly cover the spectrum of opinion on cryptocurrencies as an investment vehicle. Both come from experienced investors who have been successful for decades and who follow the same value-oriented, long-term investment philosophy that was largely coined by Warren Buffet: “value investing.”

However, they also clearly show a problem: crypto is quite obviously not crypto; positions sometimes diverge diametrically. This in turn leads to great uncertainty among experts, and even more so among the general public. Especially when authorities, who are considered to be experts and responsible in their actions, make such contradictory statements, it is no longer understood what is valid, or whether and whom one can believe. Pointed statements like those of Charlie Munger lead to “FUD” (Fear-Uncertainty-Doubt) among the general public: A subject that is beneficial in many areas, but complex, is no longer understood.

This article aims to shed some light into the crypto fog and help distinguish crypto-scam from crypto-value. It will show which cryptocurrencies have intrinsic value and how this could be measured in the future using fundamental value analysis approaches. The two largest and oldest cryptos, BTC (of the Bitcoin network) and ETH (of the Ethereum network), serve as reference points and examples.

2. Cryptos with and without intrinsic value

The term “crypto” is part of this fog, diffuse and vague. It was coined with the introduction of the first and still largest cryptocurrency: Bitcoin. Today, crypto amongst others stands for cryptocurrency, cryptoasset, or crypto token. Since the first BTC token was issued in 2009, thousands of cryptos have been released, creating a flood of terminology along with it. A clarification of terms is therefore helpful.

2.1. Cryptoassets and token

As a possible investment instrument with intrinsic value, the term cryptoasset is central and as a definition, the following, own, may be appropriate:

A cryptoasset is a digital asset that serves as a medium of exchange, a store of value, or an investment vehicle and uses cryptography to secure transactions and control the creation of new entities. It enables peer-to-peer transactions by using distributed ledger technology (“DLT”) with blockchain technology and operates without central authorities such as government agencies or financial intermediaries.

Cryptoasset is often used synonymously with cryptocurrency, but is the umbrella term. Cryptocurrency is a specialty term used to describe the case where a cryptoasset functions primarily as a medium of exchange.

Thus, CBDCs (Central Bank Digital Currency) pushed by national banks fall out of consideration as cryptoassets. While they first emerged in response to cryptocurrencies, they are issued centrally by central banks. They also do not necessarily use blockchain technology.

Cryptoassets are often also referred to as (crypto) tokens. Crypto token describes an information on a DLT system that can represent rights of any kind and can be assigned to one or more public keys. Against a regulatory background, such tokens were further subdivided early on into payment tokens, utility tokens and asset tokens in order to regulate the applicability of money laundering regulations or securities legislation.[3] However, nothing can be derived from these regulatory terms for the valuation of an intrinsic value, which is exemplified by asset tokens. These represent asset-pegged rights mapped on the blockchain. The right is embodied, but never the real asset. This always remains together with the intrinsic value outside the token or the DLT system.

For the assessment of intrinsic values, another token concept is in the focus here.

2.2. Native token with intrinsic value

At the center of the valuation method for an intrinsic value presented here is the so-called “native token”.

Native Token:

Native tokens emerge from the blockchain itself, either originally with their creation or later through minting. Both the issuance procedure is codified in the blockchain’s own protocol or smart contract as well as the so-called consensus procedure, which determines how native tokens are to be minted later on the blockchain, for example via PoW for BTC and via PoS for ETH (more on this below). Native tokens, sometimes also referred to as “native currency” or “coin” for short, do not compete with the regulatory token types described above but can also fall under them. For example, BTC as a native token is simultaneously qualified by regulators as a currency token.

By contrast, not a native token is an NFT (non-fungible token). An NFT represents a unique asset such as a real or virtual work of art. Unlike native tokens, it is created through so-called tokenization. This involves creating a crypto token that embodies a physical or intangible good, which can then be stored, transferred or traded on a blockchain (more on tokenization of real goods in another article).

Intrinsic value:

In traditional stock valuation, which we borrow from here, intrinsic value is the value of the company that issued the stock. The valuation is based on an analysis of the fundamentals and characteristics of the company.[4] The intrinsic value of a stock thus reflects the actual value and not a market price, which is based on supply and demand and may be undervalued or overvalued. The terms fundamental value, fair value or floor value are also used for intrinsic value.

With the native token, an intrinsic value is derived directly from its own underlying blockchain network. The native token draws this from its network function as the primary medium of exchange and store of value. The two most prominent and largest cryptoassets as native tokens are BTC and ETH.

2.3. BTC and ETH: Native cryptoassets with intrinsic value

BTC and ETH (“Ether”) denote the (native) tokens and are to be distinguished from Bitcoin and Ethereum as their respective blockchain networks. Both tokens can be traded via exchanges or peer-to-peer, i.e. directly between individuals, with trading via an exchange resulting in a market price. In contrast, the fundamental value is derived from the benefit of the network platform for its participants. As a valuation object, BTC and ETH furthermore differ in some essential aspects.

2.3.1. Bitcoin – A decentralized payment network

The white paper, published in 2008 under the pseudonym Satoshi Nakamoto, describes Bitcoin as “a purely peer-to-peer version of electronic cash [that would] allow online payments to be sent directly from one party to another without going through a financial institution” For the first time, ownership of virtual property is possible without the need for a central authority such as a bank.

Through the network currency BTC, the network is operated, esp. the miners are compensated. In addition, the coin serves as a store of value and as a medium of exchange, which is why it is attributed the characteristics of a currency. In contrast to state currencies, whose monetary amounts are constantly being expanded, the amount of Bitcoins is limited to 21 million from the start, making BTC a scarce commodity, similar to gold, which is why it is also called “digital gold”.

Put simply, then, Bitcoin can be described as a peer-to-peer electronic payment system that operates in a fully decentralized manner, and whose value is directly reflected in BTC as its own (private) and limited-quantity cryptocurrency.

2.3.2. Ethereum – A decentralized multipurpose network

Ethereum has existed since mid-2015 and was described by its co-founder Vitalik Buterin in a whitepaper in 2013. The Swiss-domiciled Ethereum Foundation defines the network as follows:

“Ethereum is a technology that serves the common good. It is a worldwide system, an open-source platform to write computer code that stores and automates digital databases using smart contracts without relying upon a central intermediary, solving trust with cryptographic techniques.”

Designed as a multipurpose platform, dApps (“decentralized applications”) can be programmed on Ethereum via smart contracts by anyone, creating a wide variety of applications and business models. Its multipurpose capability sets Ethereum apart from Bitcoin (exclusively a payment network). It is its unique selling point and brand essence (more on this in an earlier article). Further, since the protocol upgrade in September 2022 (also referred to as the “Merge”), the network uses a Proof-of-Stake (“PoS”) consensus process, rather than an energy-intensive PoW (Proof-of-Work) like Bitcoin.

The two native tokens, BTC and ETH, thus derive their respective intrinsic value from different uses: BTC from the utility of its peer-to-peer payment platform and its potential as a currency, whereas ETH from its multipurpose capability and utility as a growing ecosystem around the applications that thrive within it.

3. Valuation methods

3.1. Traditional fundamental value analysis – The counter concept to speculation

Valuation methods have long been established in stock analysis. Traditionally, a distinction is made between the following two. Increasingly, such methods are also used for cryptocurrencies.

The technical analysis method aims at forecasting short-term price trends or entry and exit points by means of statistical analysis of price and volume data, exploiting price fluctuations and thus achieving price gains. Fundamental values are not taken into account. For both traditional securities and crypto investments, the application requires a lot of experience, expertise and skill to avoid remaining pure speculation.

In contrast, the method of “value investing” aims at the intrinsic value of an investment. Value investors look for assets that are significantly undervalued relative to the traded market price and assume that their valuation will be reflected in the market (price) over the long term. Value-based investing focuses on intrinsic value and is designed for the long term, not price and speculative short-term gains.

Approaches to this fundamental value analysis are also increasingly emerging for crypto investments. For example, it can be used to hide the enormous market volatility, and there is no need to keep an eye on positions 24/7. An idea of what a fundamental value analysis tool for crypto stocks might look like can be found at Coinfairvalue, for example. However, its model differs significantly from the one presented here.

3.2. Crypto – Arrived in the traditional financial analysis

Recently, the renowned CFA Institute, which awards the CFA Charter and is considered the gold standard of investment analysis, has also been looking into the valuation of cryptoassets; it issued a research paper on the subject in January 2023. This is remarkable, it means that crypto has now fully arrived in the traditional financial world. Just 2 years ago, the debate was whether cryptoassets had any quality as an asset class at all. Today, the answer is largely in the affirmative: Cryptoassets are seen as an alternative asset class, comparable to commodities, for example.

In equity analysis, their intrinsic value is calculated based on 1) present value or discounted-cashflow, 2) multiplier models, and 3) asset-based valuation models or a combination thereof. The difficulty for cryptoassets, however, is that the valuation parameters required depending on the nature of the asset in question, such as cashflow, earnings, or balance sheet assets, are not available or not sufficiently available, so they largely lead nowhere.[5] For example, cryptocurrencies with a primary function as a medium of exchange, such as Bitcoin, lack data points like interest rate differentials or measurement techniques for purchasing power of goods and services.

4. Crypto: Intrinsic value from own network

For the above reasons, the CFA Institute proposes an approach adapted for the crypto world that makes native tokens the valuation object for fundamental intrinsic value analysis.

4.1. The use case oriented network approach

The so-called use case oriented network approach is based on a demand oriented view and ignores supply oriented aspects.[6]

The network approach builds on the so-called Metcalfe’s law, according to which the value of a network grows exponentially with the growth of its users.[7] The number of active users of a network is thus its central measurement parameter.

The other aspect of the model comes from an analysis of the main economic use cases of the native cryptoasset and its specific measurement points: Intrinsic value is underpinned by these base use cases regardless of economic or market conditions, thereby determining how its participants actually use the instrument:

Value-creating factors for the intrinsic value of the native token are thus the number of permanent users of its use cases, or at least for these users.[8]

This also helps explain why even at the low point of a crypto winter, investment instruments such as Bitcoin or Ether do not fall to zero. The underlying base use cases ensure sustained demand even in the most adverse market conditions and guarantee a minimum value equal to the intrinsic token value at the time. The last time such floor values were observed was from November 2022 to January 2023. BTC never fell below the USD 16,000 mark, ETH never below USD 1,000.

4.2. The economic use cases of the network

So, in addition to the number of active users (network idea), the various economic use cases of a blockchain network and their measurement parameters need to be understood. A list has emerged of use cases that have the potential to be an enduring source of demand for cryptoassets and contribute to its intrinsic value.[9] It is not considered exhaustive and will also change over time.

- Store of value (BTC + ETH)

- Cryptocurrency as an alternative form of money or currency (BTC + ETH)

- Investment and speculation (BTC + ETH)

- Source of funding for illegal activities (BTC + ETH)

- Other uses (BTC + ETH).

- DeFi, including lending and borrowing (ETH)

- Smart contract applications (ETH)

- Tokenization of real-world assets and processes (ETH)

The cryptoassets BTC and ETH both host several enduring economic use cases. We shed light on the more robust of them here.

4.2.1. Store of value (BTC + ETH)

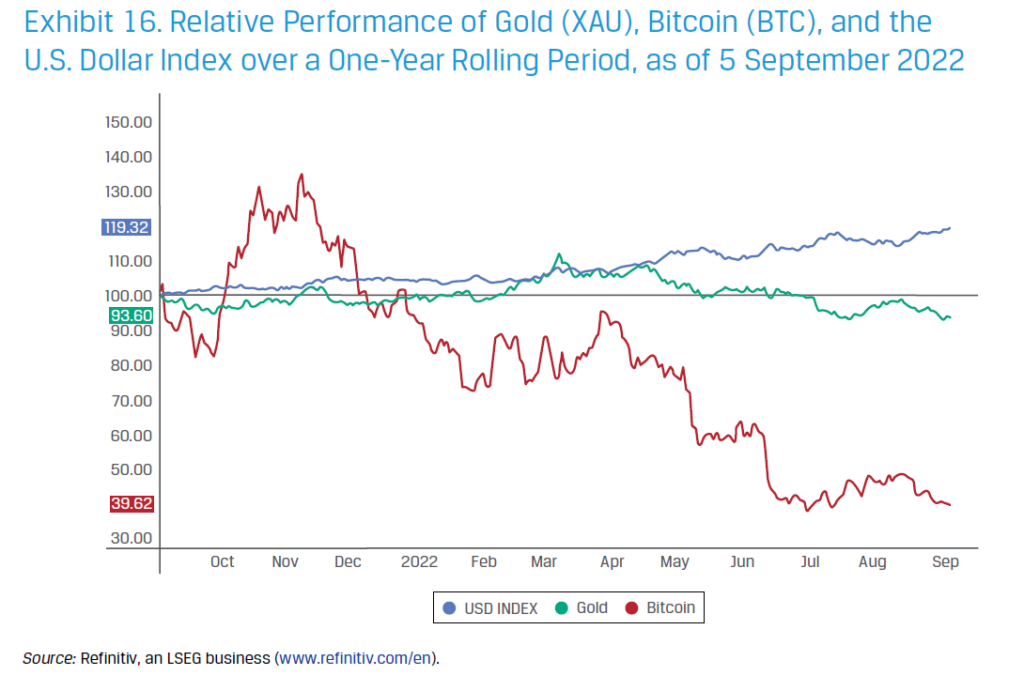

Bitcoin is digital gold. It is often claimed that Bitcoin is a hedge against inflation, similar to gold. However, especially in the past months when inflation was and still is experiencing highs worldwide, this effect could not be proven as the chart below shows. Only time will tell whether Bitcoin will be able to establish itself permanently as a store of value and inflation protection and as an alternative to physical gold.

The same can be said of ETH, which is also often referred to as digital silver. Unlike BTC, however, ETH has had an additional deflationary effect since its protocol change last September, and this could have a positive impact on its demand in the future.

4.2.2. Alternative form of money or currency (BTC + ETH)

Bitcoin is the purest of all cryptocurrencies and form of money. Nevertheless, even it does not (yet) meet all three formal qualifying requirements for money:

- BTC is not yet a store of value (see above).

- BTC is not yet a unit of account. If it were, its value would not always be expressed and measured in its fiat equivalent (usually USD). However, with more widespread mass adoption of BTC, this criterion could be met in the future. Consider, for example, countries like El Salvador, which have already approved BTC as an official alternative currency.

- BTC is unquestionably a medium of exchange

Regardless of this formal consideration, Bitcoin or even ETH have already achieved money-like status outside of El Salvador. How else can it be explained that central banks are experimenting with CDBCs, would they not see private cryptocurrencies as a threat to their own state currency? It can be assumed today that the usage as money will become permanently established, driven in particular by mass adoption in countries in the southern hemisphere, most of whose unbanked inhabitants.

4.2.3. Investment and speculation (BTC + ETH)

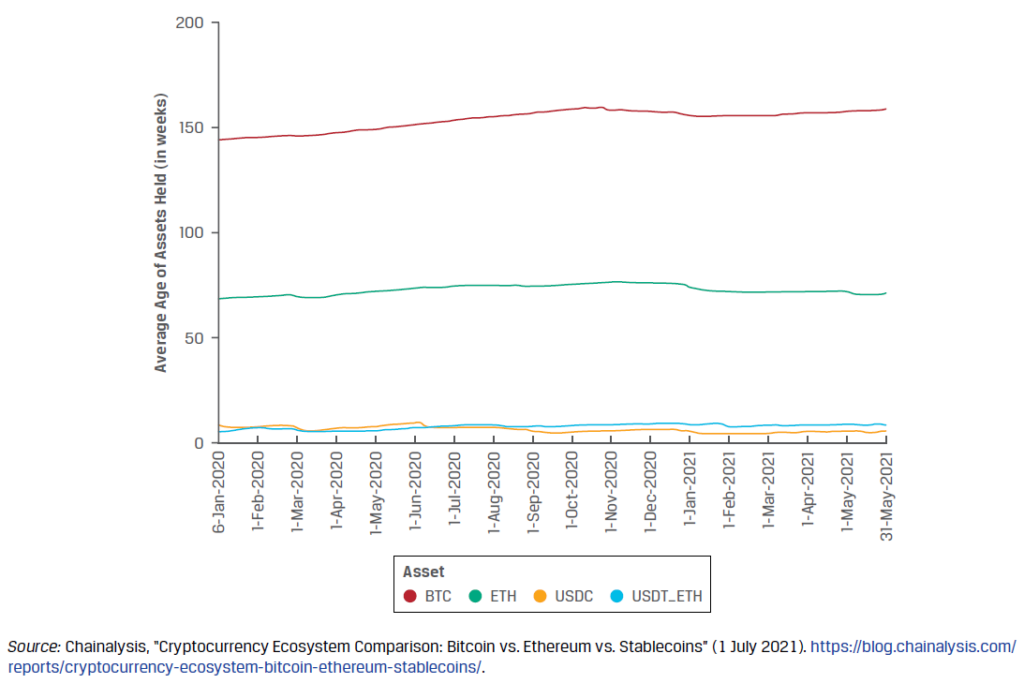

There is undoubtedly a high demand for this economic use case, which results from speculation and short-term trading, but also “buy-and-hold” strategies (called “hodling” for short among crypto investors). While the crypto market is not yet maturely developed and the data available from crypto exchanges is also still unreliable, there are some indicators that are already taking hold. Cryptoassets are now seen as alternative investment instruments. They can thus be part of a diversification strategy of a financial portfolio and their addition can have a positive impact on its performance (measurable via Sharpe ratio, for example). Furthermore, especially for BTC and ETH, another indicator for long-term investments is the average holding period of a token. The chart below shows that this is around 150 weeks (just under 3 years) for BTC and just under 70 weeks (1 year and 4 months) for ETH. However, for other coins, this use case is not likely to materialize yet.

For ETH, the aforementioned “Merge” last year and the switch to the PoS consensus process results in yet another long-term investment case, so-called “staking”. In this case, participants use their cryptocurrency as collateral to validate transactions and create new blocks, and receive compensation for doing so, comparable to interest on a savings account. This creates an incentive to keep ETH locked in for as long as possible. This should extend the average holding period, reduce the volatility of the currency and have an overall positive impact on the ETH investment purpose.

4.2.4. DeFi

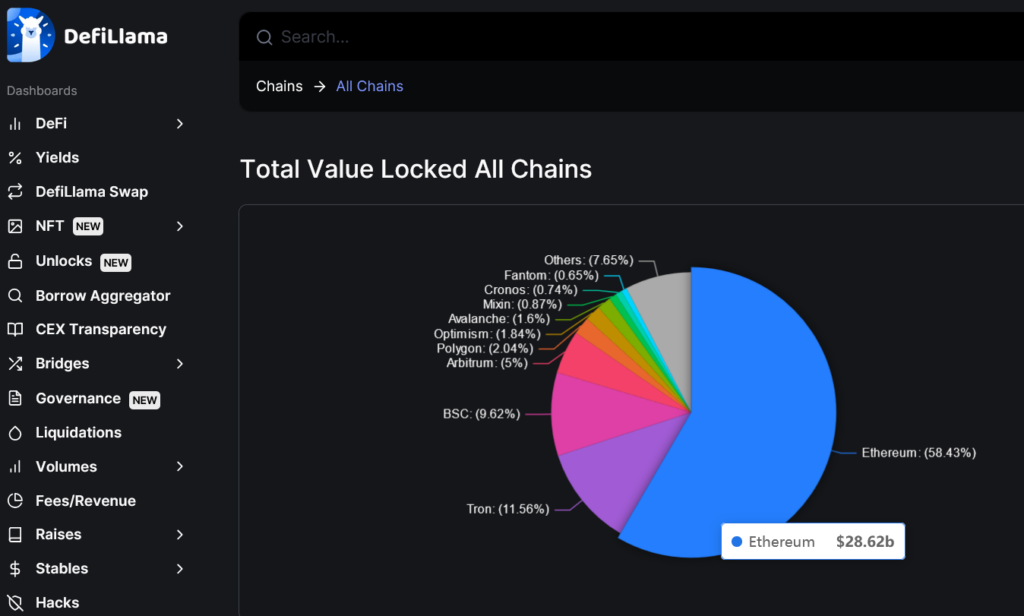

DeFi (“Decentralized Finance”) is currently perhaps the most robust and well-known of the Ethereum network’s own economic use cases: DeFi stands for the decentralization of financial activities such as lending and borrowing through the use of (public) blockchain protocols. Corresponding financial transactions are thus conducted without central entities such as banks or (central) exchanges. The DeFi sector originally emerged from the Ethereum network. Currently, the Ethereum share of the DeFi sector is still > 58%. This corresponds to approximately $28 billion in TVL (Total Value Locked), the measurement indicator for the DeFi sector, which corresponds to the total value of tokens deposited in a DeFi protocol.

Demand is stable despite the current crypto winter, but the breakthrough to sustained demand has not yet been achieved, and institutional investors in particular are still cautious. This could change, however, if the gaps in crypto investment regulation were closed; the EU, the UK and Switzerland have already made progress in this regard, while the U.S. is yet to do so. DeFi therefore already represents a significant economic use case for the ETH token today, and even more so in the future, should the breakthrough actually take place.

4.2.5. And financing illegal activities?

This use case is largely fog and FUD. Yes, it exists, but it is overstated: The fact is that in 2021, it is estimated that around $14 billion was transacted via crypto as part of illicit activities,[10] a marginal fraction of what is achieved within the existing traditional financial system, 2-5% of global GDP, between USD 800 billion and 2 trillion[11].

5. Conclusion

We have seen that native tokens can have intrinsic value that they derive directly from their own blockchain network. NFTs do not fall into this category, CBDCs are not crypto tokens, and regulatory token terms do not qualify for a corresponding statement.

Intrinsic value can be derived using approaches already known from traditional fundamental value analysis for equity securities and adapted for cryptoassets, first and foremost the use case oriented network approach. According to this method, both BTC and ETH undoubtedly have an intrinsic value. However, its amount can currently only be roughly estimated. Cryptoassets as an alternative investment instrument and valuation object are still in their infancy; the method investigated, together with the effective measurement parameters, still needs to be refined and a sound database to be built. In any case, however, the intrinsic value – as we have seen – has a value that is far from zero even in times of greatest market turbulence. So the foundation has been laid.

Perhaps a crypto investment is not a currency, not a commodity, and not a security in the traditional sense. But by no means is it a gambling contract with a nearly 100% edge for the house as Charlie Munger, a 99-year-old star investor of the old school puts it. Fundamental value analysis methods of the modern era adapted to blockchain ecosystems and their native tokens point in the opposite direction. Perhaps that’s why it is now time to put a Munger opinion in the FUD drawer for good, too.

Sources

[1] Wall Street Journal, 01.02.2023

[2] Forbes/SHOOK Top Advisor Summit, 13.10.2022

[3] The typology for these (fungible) crypto tokens goes back to the ICO guidance developed by the Swiss financial market regulator in 2018, which also gained international acceptance.

[4] S. CFA, refresher reading Equity Valuation

[5] Cryptoassets: Beyond the Hype, CFA Research Report, 04.01.2023: cif. 7.2.

[6] It thus hides supply-oriented valuation aspects such as tokenomics and derived scarcity-aspects, “stock-to-flow” or production costs.

[7] S. Shapiro, Carl, and Hal R. Varian. 1998. Information Rules: A Strategic Guide to the Network Economy. Cambridge, MA: Harvard Business Press.

[8] Cryptoassets: Beyond the Hype, CFA Research Report, 04.01.2023: cif. 7.2.

[9] Based on a classification in: Cryptoassets: Beyond the Hype, CFA Research Report, 04.01.2023: cif. 7.4.

[10] 2022 Crypto Crime Report of Chainalysis

[11] United Nations Office on Drugs and Crime’s money laundering overview here

Comments are closed.