Crypto-Assets – a social capital game

Why the desire for belonging and status drives the price of crypto assets.

What is driving the price of crypto assets like tokens and NFTs? Is it just the utility of blockchain technology? No, the desire for belonging and status is the key factor! That’s why the metaverse is so hot.

Crypto Asset is a rather abstract term. For many, it primarily means the opportunity to make (or lose) money quickly on crypto markets. Certainly, price developments of crypto assets (aka tokens) are to a large extent speculative in origin. However, tokens are more than that. They represent a milestone in economic and social development. Therefore, it is worth taking a look at tokens and the emergence of these (tokenization) apart from trading.

Index

What is tokenization, actually?

Tokenization is the ability to digitally represent any aspect of a product, person, company, or process and make it part of a broad digital ecosystem. In other words, tokens can be used to digitally represent and “price” any value.

The principle itself is of course not new. Shares, for example, are a representation of a company to which a value is attached. Traditional money also follows this principle, as do trading cards and many more. In all these examples, a value is represented (stock, money, trading card) and assigned a price. The price is determined from an objective and a more subjective value.

There are no real values!

It is precisely this value consideration that seems to have gone off the rails with crypto tokens. Why is the price of crypto assets like Ethereum rising so dramatically? Why do people pay several million US dollars for a picture of an ape? Why is virtual land being purchased for seemingly horrendous amounts?

Let’s take a closer look at the origin of the price of a value. The objective determination of the utility of classic values, such as sales or profit of a company, is comparatively simple. However, as already mentioned, this is only one side of the story. For even in the physical world, most price developments follow a subjective evaluation that is far more complex.

This post is not intended to be a treatise on pricing, but I would like to highlight two essential elements that are crucial for any value evaluation:

- The belief in a certain future performance

- The expression of belonging and status in a normative peer group

A few examples will show that these factors have a much greater influence on the price than the purely objective consideration of utility:

- the value of a share is determined to a large extent by the belief in a future performance of the company and the expression of one’s affiliation to a group of shareholders (tech shareholder, value investor,…)

- the value of FIAT money is determined, as the name suggests, on the basis of belief in the power of the securing government and is an expression of belonging to the political system behind it

- the value of a Panini trading card results from the belief in the value development on the one hand and the expression of the belonging to a certain collector community on the other hand (the fans of a club & the collectors of the cards)

So, as we can see, price determination is driven by beliefs and the desire for belonging and status in a peer group.

The Internet makes belonging borderless

In the physical world, peer groups always operate within certain boundaries. This can be a country, a political system or a market. People outside these boundaries are excluded. What is special about the digital world is that it can dissolve these boundaries. Because of the open and global nature of the Internet, digital services are in principle available and usable without borders.

The possibilities of expressing belonging and status in global peer groups were made clear by social networks. With them, it became easy to establish global communities outside physical borders. But these systems are also based on boundaries. In this case, they are not determined by a political system but by companies like Facebook (or now Meta). These companies set boundaries by managing the belonging and status of users.

So a crucial question had to be solved for true borderlessness. How can status and belonging be linked to a value without this being done by a company or a political system?

This finally brings us to blockchain and tokens, because that is exactly what the technology and the associated tokenization enable. With blockchain technologies, it is possible to pin record origin and belonging to the value itself, rather than to a central registry (such as central banks, political systems, or private companies). Through tokenization, anything that can be expressed digitally can be connected to belonging and status. Sounds very abstract, so let’s view at some examples:

First, the protocol, the basic infrastructure itself, was tokenized. Through the ICO (Initial Coin Offering) of the Ethereum network, the (expected) benefit was mapped in the form of a protocol token (ETH) and made available to a broad mass. In this form, the development of the open protocol was financed. The ETH token represents belonging and status in the reference group of supporters of this decentralized technology. In this way, a fundamentally decentralized infrastructure was created, which provided the basis for further developments.

Since then, numerous applications have been created based on the Ethereum protocol, each of whose value proposition is represented in tokens (utility tokens).

If we look at the utility tokens, it becomes clear that the community structure is crucial for the definition of the token price. Valuation is largely based on the expression of belonging and belief in the respective project. The objective utility is subordinate to these.

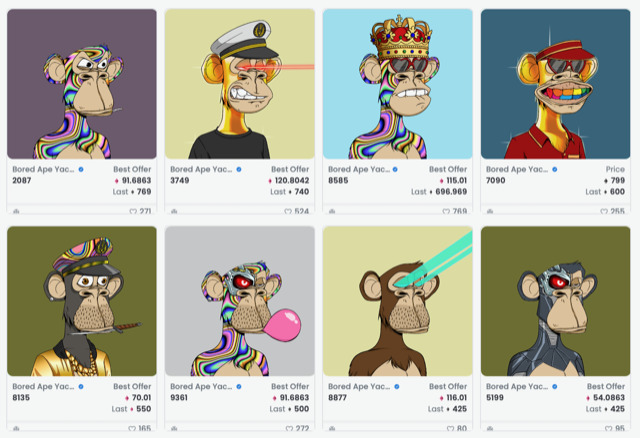

In addition to applications and utility tokens, non-fungible tokens (NFTs) are currently a hot topic. This involves tokenizing unique assets. Basically, this is comparable to trading cards in the physical world. With an NFT, a unique object (non-fungible) can be given a unique digital representation. Even more than with utility tokens, the subjective value is decisive here for pricing. How much objective value is there in a jpeg of an ape? Not much! How much value is there in the expression of belonging to the “Bored Ape Yacht Club,” a community of owners of one of the 10,000 unique Bored Ape NFTs? Obviously a lot, after all, people are willing to pay ETH tokens equivalent to $3.4 million USD for a rare Ape. Owning a Bored Ape also provides utility in the form of access to exclusive services, but most importantly it is an expression of belonging to a community, an expression of status in that community, and a belief that these values will continue to grow.

If belonging and status are significant drivers of asset development, they function to a large extent as a social network. By additionally anchoring the economic notion in the form of the utility of the tokens (token economy), a digital society can emerge on the basis of the tokens that can act across the boundaries set in the physical world. The resulting dynamics can now also be controlled on the basis of the tokens or, in other words, the peer group represented by them. DAOs (Decentralized Autonomous Organizations) take on this task. In DAOs, the development and control of the organization (governance) is to be carried out by the holders of the tokens.

How the value of an asset is measured therefore depends primarily on subjective rather than objective observation. This applies not only to crypto assets, but also to them in particular. The possibilities of truly limitless communities, which are available for the first time, are driving the development. The mapping of more and more applications, the emergence of more and more NFT projects leads to the fact that the expectations originally placed in the protocols such as Ethereum are increasingly fulfilled and new, greater expectations are based on this. The higher attention and awareness leads to an increase in the community and thus more and more social capital. This is the significant driver of crypto asset developments.

Comments are closed.