Predictions for the wealth management sector in 2023

The role of technology in driving wealth management’s transformation

2022 was a bad year in wealth management, in fact one of the worst years in investment performance across most asset classes ever. But despite the extraordinary market conditions and macro-economic challenges, underlying gigatrends remained the same: demographics, the generational wealth transfer, and evolution of client expectation regarding products and services. In 2023, the combination of expectations and demands will continue to be demanding for wealth professionals; they will need to find ways to provide the holistic advice so in demand, Accordingly, pressure on traditional wealth managers and private banks continues. The need for transformation has become evident.

2022 was a bad year in wealth management, in fact, one of the worst years in investment performance across most asset classes ever. But despite the extraordinary market conditions and macro-economic challenges, underlying gigatrends remained the same: demographics, the generational wealth transfer, and evolution of client expectation regarding products and services. In 2023, the combination of expectations and demands will continue to be challengingfor wealth professionals; they will need to find ways to provide the holistic advice reiqured – Accordingly, pressure on traditional wealth managers and private banks continues to rise. The need for transformation has become evident.

The following factors are driving the change in the wealth market:

Index

The rise of alternative asset classes and private markets

First of all, wealth managers will have to start offering their customers a broader range of investment products and services, e.g. private market investments in equity, debt and exotic assets, including art, luxury items, etc. but also crypto and digital assets (see below).

The wider access to alternative asset classes is now a reality. Existing and new private asset managers have already started to offer private market assets to a larger customer base, putting pressure on incumbent wealth managers. Specialisation in managing alternative assets is critical and experienced experts are not easily available. This is not just a growth but also a retention opportunity to remain attractive for new and existing customers.

New investment strategies and mass-personalisation supported by AI

Driven by the need for personalised investing strategies, new investment and portfolio optimisation techniques are also in high demand by investors.

Portfolio optimisation technology products and services providers offer an increasing number of strategies which include mean variance, benchmark optimisation, reducing tracking error, i.e. active risks, and alternative models. Advanced investment tools apply algorithmic and artificial intelligence (AI) technology, such as natural language processing (NLP), and other methods, to automate the investment processes.

But the mass personalisation of investment strategies requires a suitable technology architecture, performant operational processes, and scalability with a seamless integration with market data providers, order execution platforms, and core systems. The substantial investment required will lead some firms to seek collaboration and partnerships, e.g. outsourcing to achieve efficiency gains and scale. Fortunately, there is a growing number of solution providers that allow such services to be consumed as a service via cloud computing and open interface standards (APIs). Such services are contributors to the rapidly evolving WealthTech ecosystem.

ESG and values-oriented investing

The trend for investing considering environmental, social and governance (ESG) factors as well as personal values is continuing. This is despite the recent headwinds from so-called greenwashing and geopolitical factors. New regulations will aim to improve this situation.

One way to support investing along personal preferences and values is direct indexing as described above.

But it’s not just the tools required to help and advise investors on their journey of value-oriented investing. Another factor which can make a difference is communication. Traditional advisers need to upskill themselves to guide their customers or bring in new talents to provide assistance.

The digitalisation of real world assets

Digital assets, i.e. assets represented in a digital form (in comparison to native crypto assets), will become more popular in 2023. The issuing of tokenised assets will be driven by traditional banks building up and providing the infrastructure to issue, trade, settle and custody digital assets.

Alternative asset classes represent a large potential for tokenisation (see above). Applying blockchain technologies, such as distributed ledger technologies (DLT) and smart contracts, can remove the high administrative costs associated with managing the typically illiquid assets across the long-term product lifecycle.

Customer centricity – digital private banking and neo-private banks

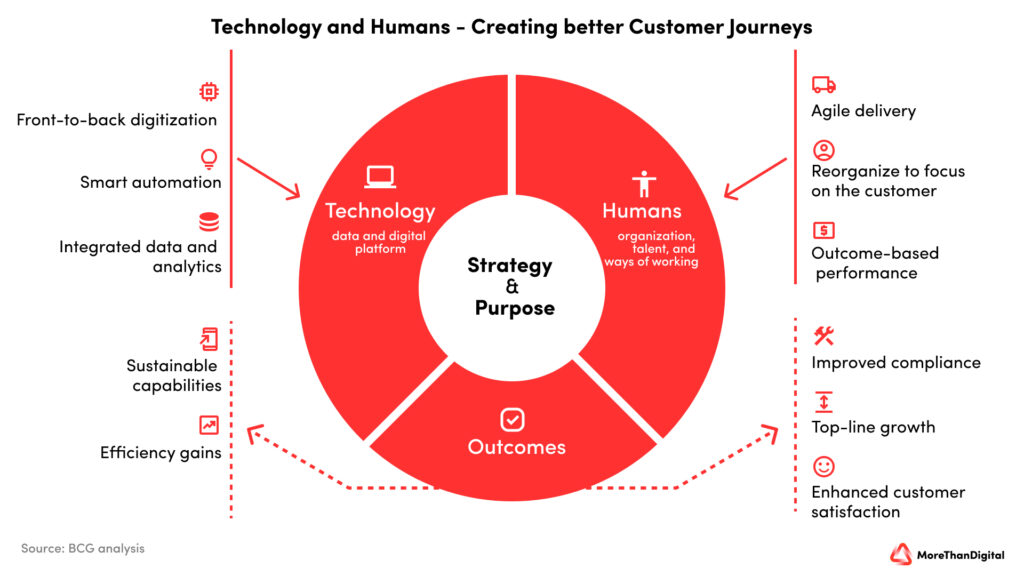

Providing wealth advice, services and products is more complex than basic banking offered by neobanks and FinTechs. A successful value proposition consists of digital services with a human touch, enabling hybrid advice [see infographic below].

Designing a personalised customer experience needs deep elaboration of client life stages and goals by applying design thinking and agile development. Embedding a superior digital user experience in combination with human advice and assistance will need, beside the human talent, appropriate technology platforms, analytics, and integration capabilities.

For neo-private banks this is critical to attracting underserved affluent and low high-net worth segments. For traditional wealth managers this can, if done properly, lead to higher customer satisfaction, and at the same time, lower costs. Neo-private banks have a natural advantage as they don’t need to consider an existing culture and legacy technology and process environment. Their challenge is to win enough customers to become a sustainable business in the expected timeframe.

Outsourcing – Wealth-as-a-Service

Family offices, independent wealth advisors but also small and large wealth managers will increasingly require specialist services including operational service and investment solution managers. The need for scale will favour specialised providers and require modern technology platforms which can be easily integrated into the legacy systems and operational processes. To offer access to alternative investments and services, wealth managers will seek partnerships with product providers to focus on holistic customer advice and acting as a distribution channel.

The development supported by technology and digitalised processes will especially benefit small family offices and independent asset managers. They can now consume services, previously only available to UHNWI and family offices. This trend will further increase the pressure on traditional service providers but also allow wealth managers driving their operational and digital transformation to better and more efficiently serve their customer base.

The digital transformation of wealth management will steadily evolve into open wealth ecosystems. Open platform architectures which are easier than ever to be integrated into the core processes, e.g. by Open Banking and Open Wealth APIs.

The role of technology in driving wealth management’s transformation

The factors driving transformational change can be grouped into three streams:

- New products and services;

- Customer experience and operational efficiency;

- Digital transformation incl. data-driven wealth management.

The three streams will require changing the way of doing things today, at minimum the operating models if not also business models. Either way, technology has a key role to play.

Using a data-driven approach enables the application of AI and machine learning, allows to mass-personalise offerings, and overcome the bottleneck of human capacity. This should not replace human advisors, but rather equip them to effectively service a greater number of clients, and increase customer value and satisfaction. I am convinced that many customers would be happy to provide their personal data if they can expect a semi-automated user experience and self-service together with expert advice and human assistance. Such an approach is also known as the hybrid advisory model.

OpenAI’s recently released ChatGPT is a demonstration of how powerful AI has become and how great its potential is to penetrate into our daily as well as professional lives by assisting (although not entirely replacing) human work.

For those wealth players with a pure customer focus, building an open platform which can easily integrate third-party services is a necessity. The increasing number of available services in wealth management leads to ‘wealth-as-a-service’ providers. But given the complexity of customer requirements and breadth of products and services in wealth management it will not lead to one player being able to offer a complete range of services and products from one platform.

In the affluent segment, the winners will be platform-based wealth advisors including neo-private banks which can build a cost-efficient yet mass-personalised service and product offering. Traditional wealth managers who successfully design and implement a holistic and consistent customer experience will continue to be among the wealth management leaders.

How can wealth managers become future-ready?

The key success factors are strategy and vision, culture, people, and technology. These elements need to be orchestrated to (re)create a value proposition, process landscape and architecture blueprints, quite like an assembly line in industries for high-value and high-tech goods such as the automotive industry.

The integration with legacy core technology is challenging and won’t become easier over time because the complexity and number of new products and services will increase. This requires an open technology architecture which allows a fast integration of old and new services. A stepwise migration to such a service integration platform will enable wealth managers, private banks, and independent wealth advisors alike, to ready themselves to operate in an ecosystem environment.

New and increasingly complex customer requirements as well as technology will be the key drivers in the development towards an open wealth ecosystem. More customers will have access to a wider range of products and services than ever before.

I am curious to see how 2023 will develop considering my predictions.

Sources

- Private Banker International, wealth management trends 2023: com/features/the-future-of-private-banking-in-2023/

- Capgemini Top Trends 2023: com/insights/research-library/top-trends-in-wealth-management-2023/

- Top trends of 2022, Sabrina Bailey, LSEG, via Reuters: com/perspectives/future-of-investing-trading/wealth-management-insights-top-trends-of-2022/

- Private market investments, Mercer report: com/our-thinking/wealth/private-markets-top-considerations.html

- The Institutionalisation of DeFi, Urs Bolt, More than Digital, 2022: info/en/the-great-convergence-the-institutionalisation-of-defi/

- Analytics in WM, McKinsey, 2022: com/industries/financial-services/our-insights/analytics-transformation-in-wealth-management

- Women, McKinsey, 2022: com/industries/financial-services/our-insights/wake-up-and-see-the-women-wealth-managements-underserved-segment

- Alpian blog, ivest: i-vest.ch/

- Direct indexing solutions, MSCI: com/our-solutions/indexes/direct-indexing-solutions

- Direct indexing, Cerulli Associates via Yahoo: yahoo.com/news/cerulli-associates-projects-direct-indexing-120100450.html

- Direct indexing report, Cerulli Associates: com/resource/white-paper-the-case-for-direct-indexing

- Direct indexing solution, Allindex: com/

- 8 trends 2023, April Rudin, Think Advisor, December 2022: com/2022/12/28/8-trends-that-will-reshape-wealth-management-in-2023/

- Costs of Swiss Private Banks, PWC, 2022: ch/en/insights/strategy/private-banking-market-update-2022.html

- McKinsey interviews with private banking RMs, 2021: https://www.mckinsey.com/industries/financial-services/our-insights/analytics-transformation-in-wealth-management

- Lower tiers of wealth pyramid a potential goldmine, Private Wealth Management, September 2022: com/Wealth-Management/Business-Models/Lower-tiers-of-wealth-pyramid-a-potential-goldmine-for-wealth-managers

Comments are closed.