Fiscal policy – economic cycle and developments in the energy crisis

Scenarios and outlook from energy crisis to economic development

Die Energiekrise und Pandemie dämpfen die wirtschaftliche Entwicklung. Auf den Welt-Energiemärkten zeigt sich eines ganz klar: Wir werden mit hohen Energiepreisen leben müssen. Deshalb stellen sich Fragen wie: Wie wird sich die Wirtschaft entwickeln und welche Massnahmen zur Bekämpfung einer bevorstehenden Rezession gibt es?

Index

Pandemic and energy crisis

The pandemic and the energy crisis dampen economic development in Germany and around the world. Characterized by high infection figures and the start of the Russian war of aggression in Ukraine – with restrained economic momentum. Adjusted for price, calendar and seasonal effects, gross domestic product (GDP) grew by only 0.2 percent compared with the previous quarter. According to surveys by the ifo Institute, the assessment of the situation in the manufacturing sector improved somewhat in May after two consecutive declines. However, companies remained noticeably skeptical with regard to the coming months, also in view of the recent weakening of incoming orders. By contrast, in the services sector, the situation assessment improved as strongly as last seen in June 2021, which is likely to be driven primarily by areas benefiting from the easing Corona situation. All in all, economic development in the near future is likely to continue to be characterized by the tension between industry being impacted by material bottlenecks and high energy prices on the one hand and positive impetus from the services sector on the other. However, the risks to further economic development remain considerable, particularly in view of the war in Ukraine. According to a recent survey by the ifo Institute in May, 53.7 percent of companies in the manufacturing sector said that the lockdowns in China had further exacerbated their production constraints. With a noticeable decline at the start of Q2 2022, real retail sales in April reached their lowest level since February 2021. This is also likely to have reflected effects of the war in Ukraine in the form of additional price increases and heightened uncertainty. Sales declined by 5.4 percent in April compared with the previous month, adjusted for price, calendar and seasonal effects. Compared to the same month last year, retail sales were down 0.4 percent (BMF June 2022 Monthly Report).

The inflation rate (year-on-year change in the consumer price index) rose again in May 2022 at a sharply higher level and, according to calculations by the Federal Statistical Office, stood at 7.9 percent in May, compared with 7.4 percent in April 2022. This corresponded to a non-seasonally adjusted increase in the index of 0.9 percent compared with April. The last time the inflation rate in Germany was similarly high was in the winter of 1973/1974 as a result of the first oil crisis. The main driver continues to be the price index for energy, whose year-on-year increase accelerated somewhat to 38.3 percent (after 35.3 percent in April). Moreover, the very strong price increases at the upstream stages of the value chain, especially for energy but also for other products, are increasingly having an impact on the breadth of consumer goods prices (BMF Monthly Report June 2022).

Inflation trend

The high inflation rate, which this year is expected to reach 6.8%, the highest level since 1974, is in itself holding back the recovery in private consumer spending. This is probably the main reason why the mood in the retail sector has deteriorated recently. The loss of purchasing power due to sharply rising prices will probably not be offset either by the rise in net wages or by the increase in government transfer payments. While consumer confidence in the euro zone has plummeted since the outbreak of war in Ukraine, sentiment in the services sector has remained persistently optimistic. The momentum there is largely driven by recovery effects following the pandemic-related closures and is proving to be a pillar of economic activity. Manufacturing, on the other hand, is increasingly suffering from the glaring price increases and ongoing supply chain difficulties (ifo economic forecast, June 15, 2022).

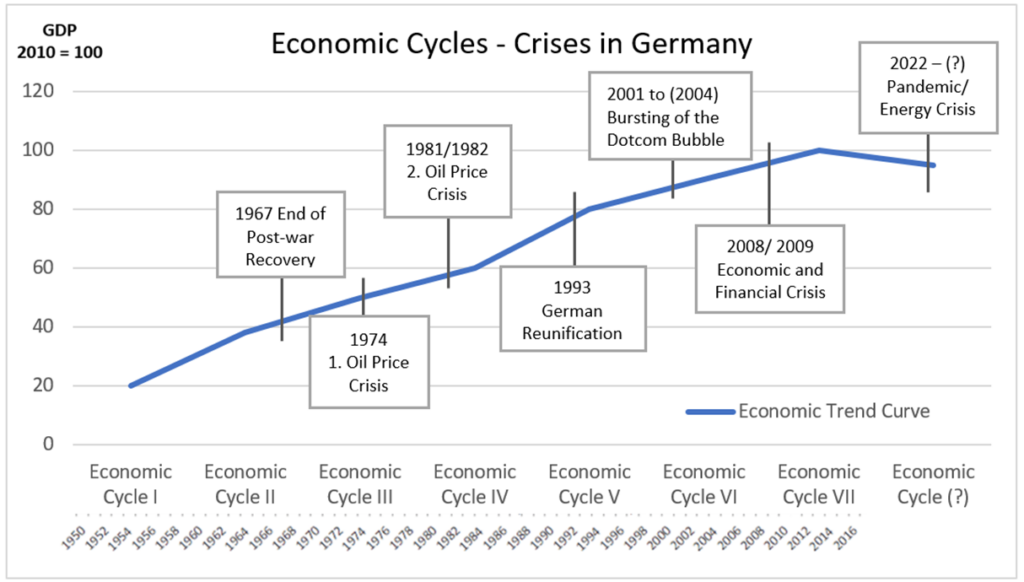

Business cycles – the example of Germany

The following chart illustrates economic cycles and crises using Germany as an example.

The chart shows that business cycles can last for different lengths of time. In addition, the end of a cycle can have different causes: A downturn can have international causes or national reasons. Since the end of the economic crisis of 2008, we are now in the seventh cycle. The Current geopolitical situation with gas, grain and oil supply shortages with the inflation data shown before and currently again rising COVID19 as well as monkeypox infection numbers (WHO appoints emergency committee June 2022) indicate an economic recession in a continuing pandemic and energy crisis. The additional effects of an escalation of armed conflicts between NATO and Russia are not considered here. However, large government investments in the defense industry are conceivable, which could be lacking in other areas such as education, economic stimulus, promotion of alternative energies and health care.

Fiscal policy and its impact

Based on the assumptions of John Maynard Keynes, the state should primarily influence aggregate demand in order to improve employment in the economy. Government spending and government revenues are to be directed countercyclically, i.e. against the business cycle. Consequently, in a recession, the state must stimulate aggregate demand in the purpose of deficit financing by increasing its expenditures via revenues, and in the purpose of economic highs, it must reduce its expenditures, increase its revenues, e.g., by raising taxes, and build up reserves in order to curb economic development. However, the recipes of global control failed at the latest with the emergence of stagflation (falling growth with rising inflation) in the mid-1970s. Cyclical swings were amplified and public-sector debt rose sharply.

Development of the price index

The percentage increase in the price index in a given period is called the inflation rate. The quantity of money in the economy plays a particularly important role in the occurrence of inflation. If the quantity of goods in the economy as a whole is matched by an excessively large money supply (inflation of the money supply), one condition for inflation is met. If the aggregate demand for goods exceeds the aggregate supply of goods (reduced gas or oil supply), which cannot be increased in the short term, rising prices are the result, and inflation sets in. The price increases trigger rising wages; because of the higher income, the demand for goods increases. However, the higher wages also cause rising costs for companies, which in turn leads to price increases for goods (Duden Wirtschaft A to Z, 2016).

Coupling gas price with oil price

The coupling of the gas price to the oil price (vice versa) has mainly historical reasons. When natural gas was introduced to the European energy market in larger quantities in the late 1960s and early 1970s, fuel oil was the dominant fuel. Gas supply contracts with producing countries were signed for longer periods (20 to 30 years). At that time, it was clear to the contracting parties that the “young energy” natural gas would have difficulty gaining acceptance against the already established and popular heating oil without minimum protection provisions. For this reason, the principle of oil price linkage was anchored in most supply contracts (SFOE, Swiss Federal Office of Energy 2004). The share of gas in electricity production in EU countries is higher than in Switzerland. Since there is a limited technical possibility in power plant operation to switch from gas to oil firing at short notice, market participants expect a certain substitution effect here (O. Klapschus, 2021, HeizOel24 News). For industrial processes and electricity production, for example, large companies buy the currently cheapest energy. Because of the increased demand, it then also becomes more expensive. The oil price peg in conjunction with long-term supply contracts protects against unilateral price demands by the natural gas producing countries. However, supplies from Russia continue to fall away. Developments on the world energy markets make one thing very clear: We will have to live with high energy prices. The focus must therefore be on the question: How can we save energy and thus money without endangering supplies in the event of supply bottlenecks or having to forego comfort? (M. Weyand, IKZH 2009).

3 Scenarios and outlook

This forecast assumes that in the second half of the year supply bottlenecks will gradually ease and raw material prices will fall. Even though order intake is now declining as a result of high prices, the order books of industrial and construction companies are still full to bursting, most recently covering a period of around 4.5 months. Provided the oil embargo imposed by the EU on Russia does not lead to a renewed acceleration in price increases, inflation in the euro zone will peak in the second quarter of 2022 and gradually weaken over the forecast period (ifo economic forecast, June 15, 2022).

2. No marked deterioration in the geopolitical situation and raw material prices

Provided the oil embargo imposed by the EU on Russia does not lead to a renewed acceleration in price increases, inflation in the euro area will have peaked in the second quarter of 2022 and will gradually weaken or at least hold steady over the forecast period. The delayed pass-through from commodity to retail prices and the compensation of real wage losses by high wage settlements will ensure that inflation in 2023 will be higher than in previous years. An overall inflation rate of 6.1% is expected for the current year and 2.6% for the coming year (ifo economic forecast, June 15, 2022).

3. Worsening geopolitical situation – raw material price increases and supply bottlenecks

Energy and supply bottlenecks – the global economy is suffering heavily from the pressure of energy and supply bottlenecks. The trade embargo on Russia is causing further countermeasures and blockages in shipping trade with shortages of grains and staple foods especially in highly dependent emerging markets and countries like Egypt. This could lead to hunger crises and uprisings there. Low wage settlements, combined with rising prices and falling demand, are causing profits and investment figures to fall. Increases in key interest rates lead to a rise in the cost of credit. Supply shortages of raw materials and materials for production reach their peak. Rising energy prices cause low capacity utilization and employment. National and European fiscal policy measures have too little effect. Tendencies toward increased saving mean that less money is available in the real economy.

Development in the USA

In the USA, the domestic economy is still proving robust and the labor market is tightening more and more, resulting in strong wage growth. Accordingly, a wider range of goods and services are affected by sharp price increases, more so than in the euro zone. Commodity price increases play a less prominent role. Inflation in the USA is less strongly driven by unfavorable supply shocks than in the euro area (ifo economic forecast, June 15, 2022).

Development in Asia

Chinese and Japanese lockdown. In China, the rigid lockdowns and traffic restrictions, particularly in Shanghai, have recently had a severe impact on the economy. The normalization process will take some time and, in view of developments over the past two years, tangible consequences for global trade in goods and the world economy can also be expected in the longer term. The Japanese economy is recovering from the pandemic-related setback at the beginning of the year, but the lockdowns in China are weighing on export demand and exacerbating supply chain problems.

European monetary policy

Yields on government bonds issued by Italy and other heavily indebted countries have soared in recent months. The reason for this is that the ECB is phasing out its securities purchases and will raise its key interest rate in July for the first time in more than a decade. In doing so, the monetary guardians want to curb inflation. In addition, investors are demanding higher risk premiums for their money from such countries. This is costing these countries billions. This puts the central bank in the difficult position of raising borrowing costs for the euro zone as a whole while limiting them for some of its weaker members. The development comes at a time when a lot of money is needed in the fight against a looming recession and to relieve businesses and consumers from high energy prices. That’s why the ECB is planning a yield brake, the specifics of which are still being worked out. According to insiders, the ECB could withdraw money from the banking system in return. This is intended to offset possible bond purchases to cap borrowing costs for highly indebted euro countries, two people familiar with the plans told the Reuters news agency. The new system, which aims to combat financial fragmentation among euro countries, is expected to be unveiled at the ECB’s Governing Council meeting on July 21. The ECB should make a qualitative assessment of the credibility of fiscal policies and take into account countries’ respective efforts to put their debt policies on a sustainable path. The ECB has so far signaled that it will raise its key interest rate in July for the first time since 2011 – by a quarter of a percentage point (Handelsblatt June 28, 2022).

Conclusion and outlook

In the seventh economic cycle as well as energy crisis, a recession must continue to be fought. To look for further alternatives to gas from Russia seems urgent. It is doubtful whether Qatar, as a supplier of liquefied gas, can solve Europe’s problems by building and expanding such production and storage facilities. You run away from the Russians in Europe and end up in their lap in the Gulf. A solution can only be European. You can’t rely on the political instincts of the Europeans, but you can rely on their science. They will have to invent new things (R. Ghadban, 2022). In the case of subsidies, it is important that the state also acts as a protective hand within a set of rules and antitrust laws. Accompanying measures such as a reduction of the mineral oil tax should not only fill the coffers of the mineral oil companies. With a consistent exit from nuclear energy, a purchase of the same electricity from neighboring countries is conceivable.

When transporting grain from Ukraine for dependent countries, further logistics solutions and land routes must be developed.

The European Central Bank must manage the balancing act between increasing borrowing costs for the euro zone and at the same time limiting them for its weaker members by capping bond yields.

The accumulated experience in dealing with the COVID19 pandemic, should lead to faster action and avoidance of lockdowns. Hasty easing in the summer wave with a view to a coming fall wave must be questioned (Spiegel 02.07.2022).

Comments are closed.