The Financial Life of Filipinos: Insights into Wealth Distribution and Financial Literacy in the Philippines

Evaluating the Present Landscape and Perspectives on Financial Literacy in the Philippines.

Understand how the socio-demographics, growth resilience, and evolving financial literacy in the Philippines are shaping its diverse and resilient economic landscape.

This research article aims to provide insights into the financial situation and financial literacy of Filipinos on a meta level, targeting two key audiences: individuals seeking a comprehensive understanding of the broader financial landscape in the Philippines and experts, government representatives, and professionals from organizations focused on financial inclusion, education and literacy.

Index

An Overview of Wealth Distribution in the Philippines

Population and Age

The population of the Philippines demonstrated continued growth over the years, estimated at 117,337,368 by 20231. The country comprised of more than 7,000 islands is geographically divided into 17 administrative regions of which the most populous are situated in the north, i.e. the regions of Calabarzon, the National Capital Region (NCR), and Central Luzon, collectively accounting for about 38.6% of the total population2.

The nation’s rich heritage includes over 182 ethnolinguistic groups, and the Filipino people’s cultural, genetic makeup, social dynamics, and historical migrations have shaped the current demographic landscape3.

Overseas Filipino Workers (OFWs) significantly contribute to the economy through remittances. The most popular professions among Overseas Filipino Workers (OFWs) are in healthcare, hospitality, and shipping, which are all in high demand abroad. These opportunities are spread worldwide, with notable concentrations in the Middle East, neighboring countries in the Asia-Pacific, and Western countries1,2,4.

In 2023, the Philippines reported a median age of 25.0 years and a total fertility rate (TFR) of 1.9 (2022), indicating below replacement-level fertility5. This contrasts sharply with most OECD countries, which typically have a median age exceeding 40 years due to lower fertility rates6. The Philippines possesses the youngest working force in Asia, with an average age of 25.4 years, notably lower than Singapore, Thailand, Australia, and the United States, where median ages range from 37.5 to 38.2 years7.

Economy, Income Development and Poverty

The Philippine economy has demonstrated resilience and growth potential despite global economic challenges, becoming the fastest-growing economy in Southeast Asia expanding by 5.6% in 2023, even amidst the Corona crisis. The GDP per capita of the Philippines in 2022 was USD 3,623, an increase of 1.3% from the 2021 GDP per capita of USD 3,5768. The country’s economic shift from agriculture to a focus on services and infrastructure build-out, but less so on manufacturing, has been a key driver of this growth. Additionally, remittances from Filipino workers abroad, which account for roughly 10% of the country’s GDP, have further supported economic development. The Philippine economy is expected to expand by 6.2% in 2024, fueled by rising domestic demand, a recovery in services, and sustained remittances from OFWs9.

The income development of Filipinos shows a mixed trend, with the poverty rate decreasing from 23.3% in 2015 to 21.1% in 2021 but then increasing to 22.4% (approximately 25 million people) in the first semester of 202310.

Biggest headache, inflation. Our hard-earned money’s worth is decreasing, and wages remain the same. I feel the pressure to get a higher-paying job, and to top it off, the government’s hiking the contributions for the social security system (SSS), Pag-IBIG, and PhilHealth. Seriously, our government is beyond useless.

‒ Anonymous from Reddit

The government is pursuing larger investments in both human and physical capital to boost medium- and long-term development. With continued recovery and reform efforts, the country aims to becoming an upper middle-income country11,12,13. Despite all the efforts, the poverty situation in the country remains a significant challenge, with 25 million Filipinos living below the poverty line. Financial literacy is often inaccessible to many due to limited education and resources. For those struggling to meet basic needs like food, the idea of saving for future emergencies can seem like a distant luxury. It is important to note that the discussion about financial literacy primarily centers on individuals above the poverty line, constituting the majority of the population. By highlighting these disparities and underscoring the importance of inclusive financial education and support systems, efforts can be directed towards addressing poverty more comprehensively in the Philippines.

Wealth Distribution and Savings Rate

Despite the high economic growth and job expansion, the Philippines continues to struggle with deeply rooted inequality14. The wealth distribution in the country is highly uneven, with the top 1% of earners capturing 17% of the national income, while the bottom 50% share only 14% of the income15. The Philippines’ Gini coefficient, a measure of income inequality, stood at 41.6% in 2021, the highest Gini coefficient among ASEAN’s six largest economies, highlighting significant income inequality in the country. This disparity is a social timebomb, with implications for wealth distribution and economic stability16.

Foreign influences, particularly Spanish, American, and Chinese heritage, have shaped the wealthy class in the Philippines, stemming from over three centuries of Spanish colonial rule, subsequent American colonization, and ongoing interactions with Chinese traders and immigrants. These historical ties are still evident in cultural norms, inheritance practices, and existing power structures.

The World Bank has emphasized the need for policies that promote greater equality of opportunity, such as improving access to quality education, healthcare, and housing17. The report also highlighted that inequality starts before birth and is perpetuated over the life cycle, impacting employment opportunities and income. The Philippines aims to become a middle-class society free of poverty by 2040, but addressing high levels of inequality is crucial for achieving this goal18.

I’ve been investing a hefty chunk of my money, so I can retire early. I don’t really dream of retiring as a rich person because that’s just unrealistic, but I have plans to live off my dividends when I get old.

‒ Anonymous from Reddit

The total personal savings in the Philippines averaged PHP 2,777,379.82 million (approx. USD 49.6 billion) from 2001 until 2022, reaching an all-time high of PHP 6,272,231.91 million (approx. USD 112.1 billion) in January 2022, up from PHP 5,274,123.59 million (approx. USD 94.3 billion) in July 202019. According to a survey on consumer expectations in the fourth quarter of 2023, about 44% of households in the Philippines had savings. The Gross Savings Rate in the Philippines was 10.8% in December 2022. This quarterly updated rate with data from March 1981 to December 2022, showing an average rate of 10.8%21.

The Financial Outlook of Filipinos

Current trend indicates a growing awareness and changing attitudes towards financial literacy, savings, and investment among Filipinos, influenced by various economic challenges and the digitalization of financial services.

Financial Literacy, Debt and Savings Behaviour

Many Filipinos spend before they save, which can lead to a lack of savings if nothing is left after expenses. While 96% of Filipinos are concerned about health costs, only 16% are prepared for medical expenses in case of critical illness due to lack of insurance or savings for emergency cases22. There is also a rising number of senior-dependents who rely on their children for financial support due to a lack of financial education, which poses a cycle of financial burden from generation to generation until corrective measures are implemented23.

The financial industry’s goal is to educate Filipinos to prioritize savings then manage spending with what’s left. The government has also taken steps to encourage saving by offering lower loan rates to micro and small business enterprises24.

I think managing unexpected expenses is a challenge. Dealing with unforeseen costs like emergency repairs, medical bills, or job loss can be stressful and disrupt financial plans.

‒ Derrick David

The debt culture in the Philippines is deeply ingrained, with borrowing money being a common practice, often viewed as a norm rather than an exception. This normalization of debt, known as “utang,” poses a significant obstacle to financial growth for many Filipinos. Instead of prioritizing saving for unforeseen circumstances, borrowing for emergencies is more prevalent. However, a lack of understanding about the implications of compounding interest and the distinction between good and bad loans further exacerbates financial challenges. This culture of indebtedness is reflected in statistics showing that close to 50% of Filipinos have debts or loans, with various forms of indebtedness such as money owed to individuals, Buy Now Pay Later (BNPL) services, and credit cards being prevalent. eWallets and digital platforms actively incentivize consumer debt, often at high rates, leading to potential debt traps. Addressing this debt culture requires promoting financial literacy and fostering a shift towards more sustainable financial practices to enhance economic resilience among Filipinos.

New Financial Attitudes, Education and Digitalization for Financial Wellbeing

Recent global uncertainties and the rising cost of living have led to new financial attitudes and behaviors among Filipinos27. Finance influencers (finfluencers) on social media have become popular for their ability to simplify complex financial concepts, which helps to improve financial literacy. The Corona crisis, for example, has particularly sparked interest in insurance products among the Filipino Gen Z population28.

Over 40% of Filipinos are now seeking digitally enabled insurance and investment products, to which insurance and financial services companies have positively responded to meet this demand29. Some have also launched financial literacy programs targeted at different demographics, including female heads of households, to empower them with knowledge on saving, budgeting, and investing30.

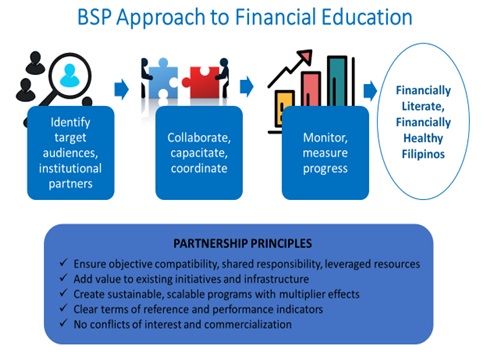

To promote financial inclusion and recognize that the digitalization of payments are mutually reinforcing, the Bangko Sentral ng Pilipinas (BSP) has outlined a Digital Payments Transformation Roadmap. The goal is to shift 50% of total retail transactions to electronic channels and increase the percentage of Filipino adults with bank accounts to 70% by the end of this year31. Key drivers propelling this transformation include QR PH, high-interest digital banks, and reduced or zero cross-bank transaction fees for certain banks32.

There’s a crucial need for financial literacy in the Philippines. Discussing money is not common in Filipino families, and there’s a cultural expectation for children to support their aging parents financially. Many believe government pensions are enough for retirement, leading to a high demand for government jobs. Changing this mindset requires recognizing that the issue is deeply rooted in Filipino household culture.

‒ Lancelot Dilig

The Bangko Sentral ng Pilipinas (BSP) launched the National Strategy for Financial Inclusion (NSFI) 2022-2028 to enhance consumer welfare through financial inclusion and resilience. It aims to bring more Filipinos into the formal financial system, addressing disparities and emphasizing meaningful access to services. Despite progress, a significant portion of the population remains unbanked. The NSFI sets targets and indicators, highlighting governance for stakeholder involvement. The strategy reflects a commitment to a more financially included and empowered society, fostering sustainable growth and shared prosperity. The central bank’s governor acknowledges stakeholders’ contributions to advancing the NSFI agenda33.

The BSP partnered with various organizations to develop financial education modules for OFWs, and plans to engage with the police force and firefighters for similar initiatives34.

I wish that my kids would handle money better than I do. I hope they won’t feel entitled to inheritance when the time comes. As parents, we tell them they can do anything they want, but we also provide an honest perspective on income generation.

‒ Margaux C.

Conclusion

The Philippines is a country with a young median age, experiencing steady population growth and an economic shift towards the service industry. Despite positive strides with lower poverty rate and economic growth, challenges such as income inequality persist in the Philippine economic spectrum.

Many questions remain as we analyze the Filipino financial landscape. Why do Filipinos tend to spend more than save, particularly during the corona crisis? Despite a long-standing culture of saving, why does financial literacy progress slowly? Moreover, what prompts the transition to the service industry, widely regarded as a catalyst for growth, and what factors contribute to the persistence of inequality? Unraveling these queries is essential for a comprehensive understanding of the dynamics shaping the financial realities of the Filipino population.

I’ve come to realize that money should always be openly discussed and communicated. Currently, I’m dealing with a lot of issues because I made poor decisions and kept them from my husband. I’m reeling from distrust, and of course, paying off debts slowly

‒ Margaux C.

Targeted actions are essential to accelerate financial development in the country, encompassing policies addressing the wealth gap and improving access to quality education and healthcare. Empowering Filipinos through financial literacy programs and harnessing digital financial services could contribute to a more resilient economy. With collaborative efforts from both the government and financial institutions, a path can be forged towards a more equitable and prosperous financial landscape for all. The outlook for the Philippine economy remains optimistic, with forecasts indicating sustained growth and private consumption supported by remittances from overseas Filipino workers.

The real challenge lies in executing strategies and translating them into tangible impact. Studies alone won’t suffice; it’s the hands-on work and activities that can truly reach the 25 million below the poverty line. Meaningful education becomes transformative when coupled with creating pathways out of their current situations, fostering hope and positive change for the future.

Tip: Read more on the Future of Wealth Management in Philippines.

Endnotes with references:

1) Macrotrends: https://www.macrotrends.net/countries/PHL/philippines/population

2) Philippine Statistics Authority, 2021: https://psa.gov.ph/content/2020-census-population-and-housing-2020-cph-population-counts-declared-official-president

3) Wikipedia: https://en.wikipedia.org/wiki/Ethnic_groups_in_the_Philippines

4) Worldometers: https://www.worldometers.info/demographics/philippines-demographics/

5) Philippine Statistics Authority, 2022: https://psa.gov.ph/content/total-fertility-rate-declined-27-2017-19-2022

6) OECD: https://www.oecd-ilibrary.org/sites/d56a2fbc-en/index.html?itemId=/content/component/d56a2fbc-en

7) CIA Factbook: https://www.cia.gov/the-world-factbook/field/median-age/country-comparison/

8) CEIC Data: https://www.ceicdata.com/en/indicator/philippines/gdp-per-capita

9) Asian Development Bank (ADB), 2023: https://www.adb.org/where-we-work/philippines/economy

10) Philippine Statistics Authority, 2023: https://psa.gov.ph/statistics/poverty/node/1684061846

11) World Bank: https://www.worldbank.org/en/country/philippines/overview

12) Investopedia: https://www.investopedia.com/articles/investing/091815/emerging-markets-analyzing-philippines-gdp.asp

13) Asian Development Bank, 2023: https://www.adb.org/news/philippine-economy-post-robust-growth-2023-2024-despite-inflation-pressures-adb

14) Wikipedia: https://en.wikipedia.org/wiki/Income_inequality_in_the_Philippines

15) IMF, 2016: https://www.imf.org/en/Publications/WP/Issues/2016/12/30/Poverty-Income-Distribution-and-Economic-Policy-in-the-Philippines-2515

16) Philippine Institute for Development Studies (PIDS), 2022: https://www.pids.gov.ph/details/income-inequality-a-social-timebomb

17) World Bank, 2022: https://www.worldbank.org/en/news/press-release/2022/11/24/ph-reducing-inequality-key-to-becoming-a-middle-class-society-free-of-poverty

18) Rappler, 2023: https://www.rappler.com/voices/analysis-incovenient-truth-philippine-income-inequality-economy/

19) Trading Economics: https://tradingeconomics.com/philippines/personal-savings

20) Statista: https://www.statista.com/statistics/1266057/philippines-households-with-savings-by-income-groups/

21) CEIC Data: https://www.ceicdata.com/en/indicator/philippines/gross-savings-rate

22) Philam Life, 2018: https://www.aia.com.ph/content/dam/ph/en/docs/corporate-governance/philam-life/2018/part-d/d.6.4-2018-annual-report.pdf

23) The National Economic and Development Authority (NEDA) of the Philippines, 2018: https://nro13.neda.gov.ph/financial-literacy-for-filipinos-understanding-for-better-living/

24) NEDA, 2018: https://nro13.neda.gov.ph/financial-literacy-for-filipinos-understanding-for-better-living/

25) Leonardo D. de Castro, Boston University, 1988: https://www.bu.edu/wcp/Papers/Asia/AsiaDeCa.htm

26) PhilStar, 2023: https://www.philstar.com/business/2023/08/18/2289378/more-pinoys-saddled-debt-says-survey

27) MDRT, 2023: https://www.mdrt.org/learn/2023/html/new-financial-attitudes-and-behaviors-emerging-among-filipinos/

28) MDRT, 2023: https://www.mdrt.org/learn/2023/html/new-financial-attitudes-and-behaviors-emerging-among-filipinos/

29) Manulife Philippines, 2022: https://www.manulife.com.ph/content/dam/insurance/ph/about-us/our-story/corporate-governance/2022-ar—mp/2022%20Manulife%20Philippines%20Annual%20Report.pdf

30) Manulife Philippines, 2022: https://www.manulife.com.ph/content/dam/insurance/ph/about-us/our-story/corporate-governance/2022-ar—mp/2022%20Manulife%20Philippines%20Annual%20Report.pdf

31) The Philippine Star, 2023: https://www.philstar.com/business/2023/12/01/2315445/bsp-deploy-more-digital-payment-tools

32) Bangko Sentral ng Pilipinas (BSP), 2020: https://www.bsp.gov.ph/Media_And_Research/Primers%20Faqs/Digital%20Payments%20Transformation%20Roadmap%20Report.pdf

33) National Strategy for Financial Inclusion (NSFI) 2022-2028, Bangko Sentral ng Pilipinas, 2022: https://www.bsp.gov.ph/Pages/InclusiveFinance/NSFI-2022-2028.pdf

34) Bangko Sentral ng Pilipinas, 2023: https://www.bsp.gov.ph/Pages/InclusiveFinance/Partnerships1.aspx

Comments are closed.