CBDC – Peak of Inflated Expectations?

Is CBDC peaking the hype or is there more to come?

Central Bank Digital Currencies (CBDCs) have become a very hot topic for the financial community. And naturally, because the potential impact of a CBDC is so significant, there is an unusual amount of ‘hype’ surrounding the topic. This article considers the current status of the debate and argues for taking time to thoroughly consider the implications of implementation of any CBDC.

Index

Central Bank Digital Currency

Among Central Bankers, the issuance of a so-called Central Bank Digital Currency (CBDC) is a topic of great interest.

So, what is a CBDC?

There is general agreement among central bankers that a CBDC is, as the European Central Bank (ECB) describes, “a central bank liability offered in digital form for use by citizens and businesses for their retail payments. It would complement the current offering of cash and wholesale central bank deposits”. It has been described as a ‘digital banknote’. And there is general agreement that a CBDC will be an fully functioning adjunct to cash not a replacement, and also agreement that a CBDC will be neither a ‘cryptocurrency’, like Bitcoin, nor a so-called ‘stablecoin’.

However, agreement stops pretty abruptly there because there are a range of opinions as to what a CBDC should look like in detail and how a CBDC should be implemented. This is hardly surprising as the introduction of a digital currency will naturally have very long-term consequences across any modern economy.

The Bank for International Settlement (BIS) has recently published a report showing that a large number of central banks, including the European Central Bank (ECB), the US Federal Reserve, the Bank of England are conducting research. Experimental projects have been set up by the Swedish Riksbank, the Bank of Israel and pilot projects have been initiated, most notably, by the People’s Bank of China (PBOC) and the Bahamas. On the other hand, some central banks, such as those of Australia and Norway are comfortable “monitoring developments” from the sidelines.

There are many sound industry and academic analyses of what a CBDC should/could look like, such as the Bank of England, BIS, economists and monetary theorists. But there is also, not surprisingly given the importance of the subject, an excess of opinion and hype.

What is Hype?

The Cambridge Dictionary defines ‘hype’ as “to repeatedly advertise and discuss something in newspapers, on television, etc. in order to attract everyone’s interest”.

It should be noted that there is nothing intrinsically wrong with ‘hype’, as it reflects the genuine enthusiasm and interest surrounding a particular topic, often a technology or social innovation. But hype inhabits the ambiguous space between fact and fiction and exists on a spectrum between knowledge and opinion, between scientific fact and, sometimes, conspiracy theory.

Hype, however, is real and an outcome of genuine interest in an innovation that has the potential to greatly impact economies and society. Hype is infectious as it appeals to the natural human tendency to be hopeful about the future. But Hype also wanes and waxes as reality slowly begins to soften the unrealistic edges of the enthusiasm surrounding any innovation as real-world practical difficulties are discussed.

Gartner Hype Cycle

Gartner Inc. is a leading, highly-respected research and advisory company, not only in the IT field but also in providing “senior leaders across the enterprise with the indispensable business insights, advice and tools they need to achieve their mission-critical priorities and build the organizations of tomorrow.”

Each year, Gartner Inc. publishes the influential ‘Gartner Hype Cycle©’ which positions the company’s assessment of several innovative, ‘emerging technologies’ on an adoption curve, for example in the “2021 Hype Cycle for Emerging Technologies”.

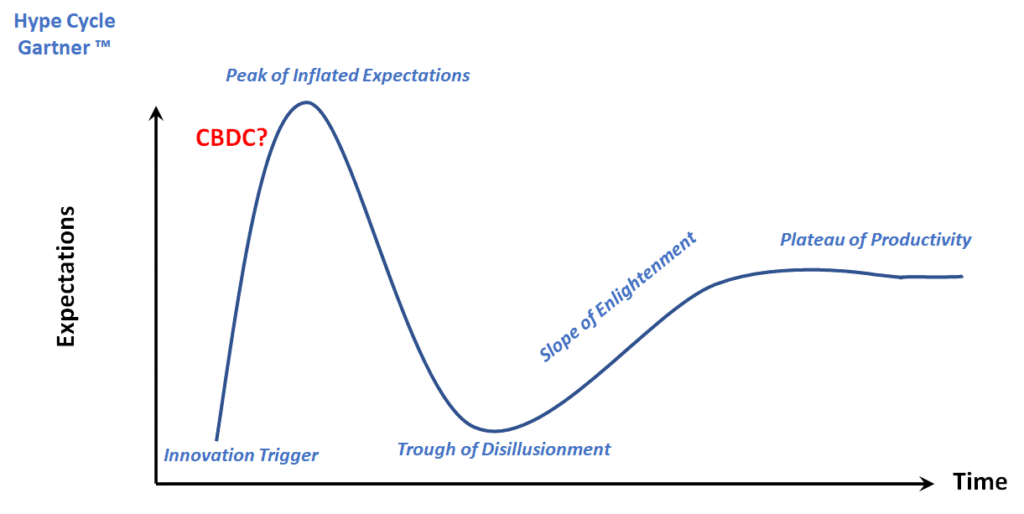

Figure 1 below illustrates the underlying adoption curve and an estimation (by the author) of where CBDCs sit at mid-2021.

The ‘Gartner Hype Cycle©’ consist of a series of peaks and troughs related to the ‘expectations’ of the wide-spread adoption of a particular technology over time, measured in years, even decades. The cycle is expressed in a number of stages

- Innovation Trigger: the invention/innovation that begins to get the attention of industry insiders;

- Peak of Inflated Expectations: after a disorganized bandwagon of hype about the technology, reality begins to intrude and expectations reach their peak;

- Trough of Disillusionment: as reality about the inflated expectations emerges, there is a steep descent into ‘disillusionment’, and many on the bandwagon jump off, as the difficulties of implementation and costs become apparent;

- Scope of Enlightenment: as the opportunities and risks of the new technology are realistically assessed and, if worth continuing with, there will be a gradual implementation over time until the technology becomes productive;

- Plateau of Productivity: eventually a successful technology will become part of the mainstream, but it should be noted with expectations of benefits much lower and much more realistic than the original peak.

It should be noted this journey will normally take many years, even decades, with multiple twists, turns, setbacks and diversions. And only the true believers will remain on the curve from the outset.

After a few years of discussion and much hype, the author has estimated CBDC to be near the Peak of Inflated Expectations not only for the reason that the topic has engaged most central banks but also has warranted a special section in an recent edition of the Economist and often reported in the influential financial press. It may, however, take months, even a year, before the peak is discernibly passed.

Meanwhile, Hype is rampant.

For example, there has been much discussion whether a CBDC could displace the US Dollar from its pre-eminent position in international trade. One expert recently claimed that CBDC “is potentially the biggest disruption in international finance since the telegraphic transfer” – that is, CBDC will be more disruptive to the banking system than the ATM, SWIFT, Credit and Debit cards, derivative securities, global equities and options exchanges, and automated share trading! Some have argued that a CBDC might aid a return to a new type of Gold Standard and a reduction of ‘dollarisation’. Others have argued that CBDCs will greatly increase financial inclusion but do not describe how exactly this could happen.

Nonetheless, such propositions however unlikely, are to be welcomed as, although the jury is still out on possible models, these discussions begin to identify the limits, limitations and likelihood of a future CBDC.

How long is the journey?

So how long could it take to get from today to the beginning of the real journey or the ‘Plateau of Productivity’ for a CBDC?

Before answering that question, however, it should be noted that we have been here before. The first recognisable CBDC was, in fact, implemented by the Bank of Finland (BOF) in the early 1990s, using newly developed smartcard technology, under the brand name Avant. Digital money was issued by the BOF, stored on the Avant card and could be exchanged with merchants, transport services and telecommunications companies and reloaded in convenience stores. However, after three years, Avant was sold off to a privately held company and the money ceased to be a liability of the Bank of Finland but was still used for commerce. However, over time the increased functionality provided by debit cards made the use of a separate pre-funded card, such as Avant, less appealing to consumers and eventually Avant was discontinued. However, the concept remains very relevant to discussions of possible models for a ‘retail CBDC’.

So again, how long would it take to get to a productive CBDC that could start to be rolled out?

From the Finnish experience it took some five years from first experiments to the initial roll-out of Avant which, in hindsight, is remarkable. For example, the most advanced CBDC today is the pilot program started by the People’s Bank of China (PBOC) in 2014 and is due to be tested in the Beijing Olympics in February 2022; that is over 7 years to get to the current state. Nonetheless, given the scope of the vision of the PBOC initiative that is not a long time either. However, both the Finnish experience and Chinese pilot only begin to start to address the problem of full-scale adoption of a CBDC in a modern, already highly digitised economy.

Modern economies already make extensive use of ‘digital money’, especially for trade, and in fact the bulk of national and international money transfers are completed electronically. Use of cash, in the form of coins and notes, in advanced economies is falling (although paradoxically the volume of ‘cash in circulation’, i.e., physical notes, is stable or in some countries rising). In the USA, the use of cash has dropped from 30% to some 19% in less than a decade, as a result of increasing use of debit cards and in Sweden, use of cash for physical payments has plummeted to some 1.7% of GDP. However, there is a persistent message that people continue to use cash for small payments. For example, in France in 2019, some 59% of payments were made using cash, but only 25% by value and in Germany, cash is still the preferred method (77%) for small payments. Physical cash appears to still have an allure for some purposes.

CBDC is Money

It must be remembered that a CBDC is real legal tender of the same standing as paper or coins in a traditional ‘wallet’. And to be useful, a CBDC would have to be available to be used wherever and whenever cash is used. So, for example, it would have to be capable of being used in every vending machine and for payment at every Point of Sale (POS) terminal in a country. It would have to capable of being used online as currency, equivalent to electronic payment systems, such as PayPal. CBDC money would have to be capable of being used for payments everywhere which means, for example, every payroll and accounting system in every firm would have to be changed to handle BOTH cash and CBDC. Eventually, everywhere where cash is used today would also have to be capable of also accepting the CBDC of the country.

This is an extremely difficult task but far from impossible. However, the rollout of a CBDC will take a long time, several years for even a medium-sized economy such as Australia and many more years for large counties such as China, USA and the countries of European Union. Probably the closest analogy is to the introduction of the Euro in 2002 (it had been used for accounting purposes since 1999) which took over a decade from 1990. Changing money takes time and is expensive.

So, assuming that the concept of a CBDC is at or near the Peak of Inflated Expectations and the bottom of the Trough of Disillusionment will not be reached for another one or two years, that would mean then we are realistically talking about completing implementation in the 2030s. There is, therefore, little need to rush the process of developing plans for a retail CBDC let alone project implementation of cross-border CBDC transfers as some Hype has suggested.

Given the confluence of new technologies and increasing demands for automating financial services, some sort of CBDC somewhere seems inevitable at some time in the (near?) future but given that money in all its forms lasts a very long time, it would be better to try to get it right first time than rush implementation.

This means, not ignoring but tempering the Hype, agreeing on what the purposes of a CBDC should ideally be, developing a technology architecture to support that vision and developing concrete and workable plans as to how to implement that architecture over many years.

For those interested, it is the author’s view that a workable CBDC will more resemble the Finnish Avant model, updated to use smartphone technology in addition to smart cards, and targeted at small payments, rather than resembling a ‘borderless currency’ such as envisaged for example, in Facebook’s model of the Libra, now relabelled Diem, supranational currency. But of course, that view may be very wrong!

Comments are closed.