Marketing as a Challenge for Startups & SMEs – 2 Different Market Research Approaches Compared

Which strategy is the right one? Is it enough just to be a creative mind or is there more to it? What do I need to consider in marketing?

Again and again I hear the same sentences from friends and acquaintances. Kambis, how do I actually get started with marketing? Here are a few tips and tricks from practice.

Again and again I get to hear the same sentences from friends and acquaintances.

“Kambis, how do I actually get started with marketing?

There are so many sources of information and articles, but somehow none of them answer the right questions.

Everything is always so theoretical and anything but practical.”

It’s always a bit of a challenge to translate theoretical knowledge into reality. How could one know which strategy works best for one’s own business model or which ones are the most effective in the first place?

Well, as with coffee, it’s the mix that counts here. An interplay of performance marketing and branding as well as a combination of online and offline activities in both areas. The personal touch.

The timing of the market launch can also play a major role. A prime example of this is the iPad. Tablets existed years before that, but it wasn’t until Apple entered this market segment, combined with their market power, that led to the overall penetration of the product.

The problem with marketing is, many don’t understand it in its basic form, others want to understand it and find no touch points, and a large portion think they understand everything, but, as in any other field, that is rarely the case. Here follows my interpretation and what I would pay close attention to: marketing is not only creative or analytical, it is not neither one nor the other, but rather both together. It is not enough to have two or three nice slogans and to be able to stage them well. It is also not something that can be learned entirely “on the go”. The theory and the psychological level behind marketing must also be known. Without this background it is difficult to understand why campaigns succeed and why others fail.

Two approaches I use are the classic Business Model Canvas and Effective Market Research, which I have increasingly relied on with my ventures in recent years. The reason why I prefer to use the EMR is simple, it is faster, cheaper and still provides me with a wealth of data.

Index

Business Model Canvas

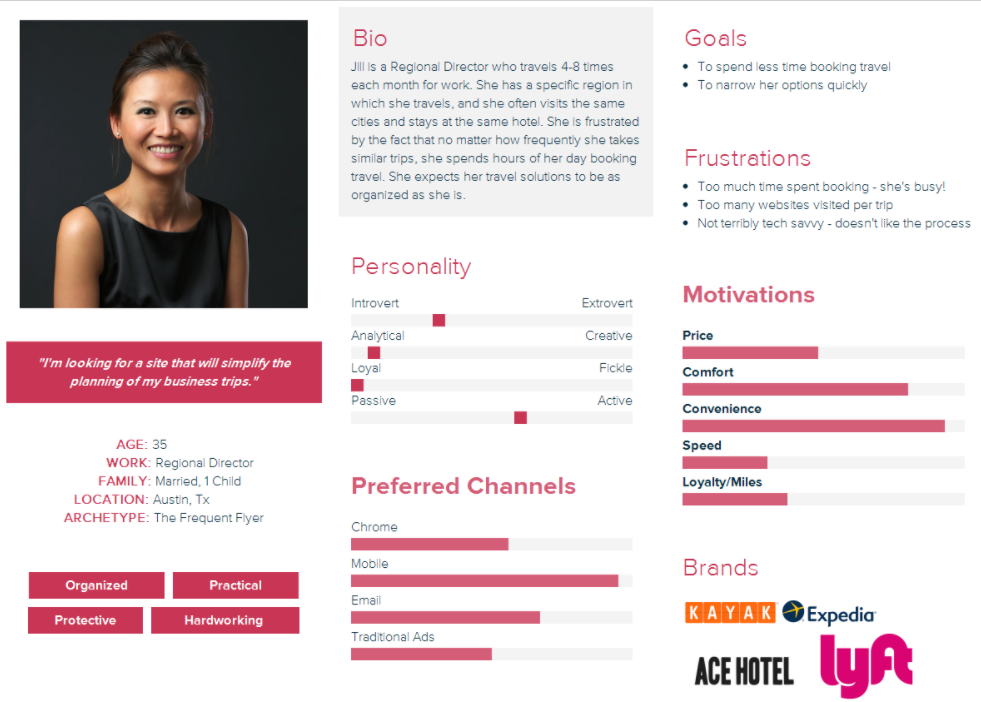

The model based on direct customer research and the creation of personas has now also established itself as a proven standard procedure on the market. The key points are to know and understand the target group, to guess the needs of the customers, to be able to “predict” their future actions, and to learn about and solve their problems. Tools such as a Customer Matrix, a Customer Empathy Map or a Customer Exploration Map help to answer these questions.

“Personas are fictional characters, which you create based upon your research in order to represent the different user types that might use your service. Creating personas will help you to understand your users’ needs, experiences, behaviours and goals.”

At the domain provider host.at services, where I am also involved, we have increasingly relied on the Business Model Canvas. Domain providers are a dime a dozen and every strategy has been used before. We had many ideas for the logo, the business model and also for the external appearance, but could not decide in which direction to go. At this point, based on the data we had collected, we decided to design an elegant, classic and simple basic logo that reflects the company’s status, and a logo version with a flower. What does this have to do with a domain provider? – There is no real connection, but that is why it is remembered, people remember it because it stands out, and by the way it looks quite chic.

Through this strategy we try to perfectly adapt the corporate identity, pricing, business model and external appearance to the previously defined, individually selected target group.

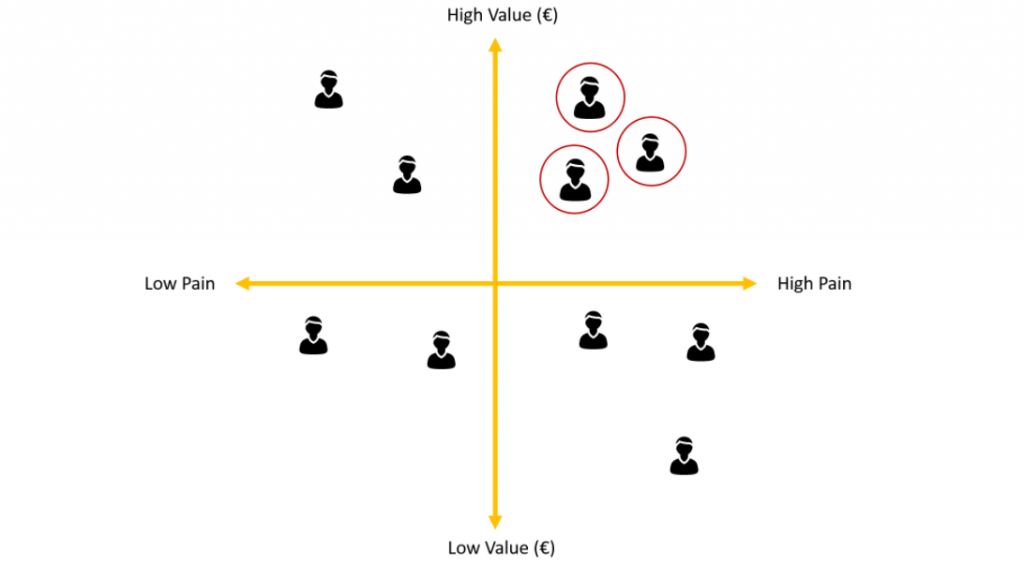

1. Customer Matrix

- Which target group do I want to address or do they feel most likely to be addressed by my product?

- How much are they willing to pay for my product?

- How strong is their need for a solution

In order to be able to sell products successfully, it must first be known which products are actually desired. What a company assumes to be this desire and what the customers actually want can be as different as cappuccino and pineapple juice. With the customer matrix, the wishes of the buyers are identified, so in the end everyone gets the coffee they ordered.

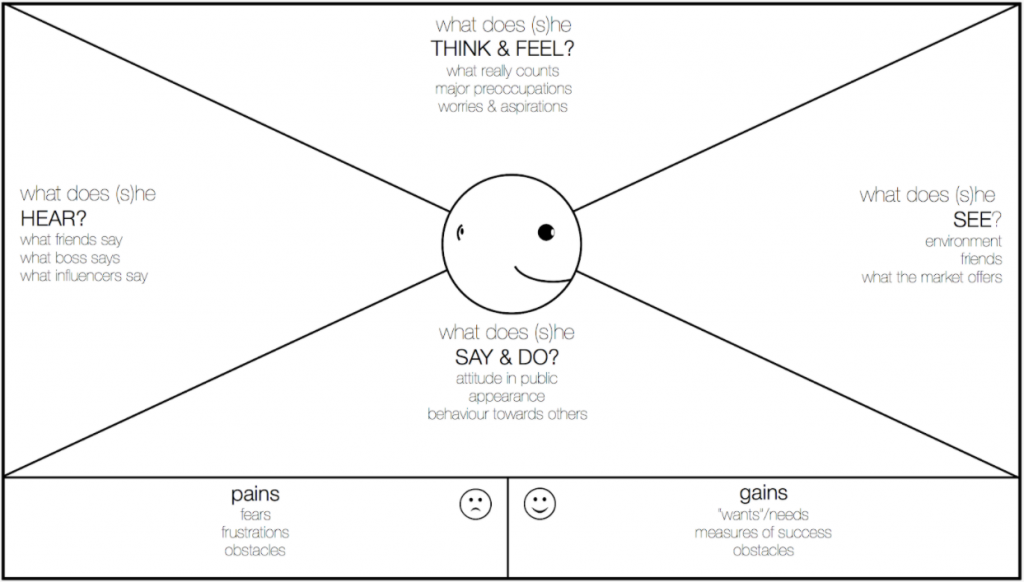

2. Customer Empathy Map

“Customer empathy” means understanding one’s potential customers. It is important to understand their emotions in relation to your brand. The Customer Empathy Map helps to visually represent, explore and understand customers’ thinking and feeling, their values, goals and fears.

Those who understand the background of their customers’ actions and also develop the necessary empathy for them can subsequently align their own offering with the needs and wishes of the entire target group in an even more focused manner than before.

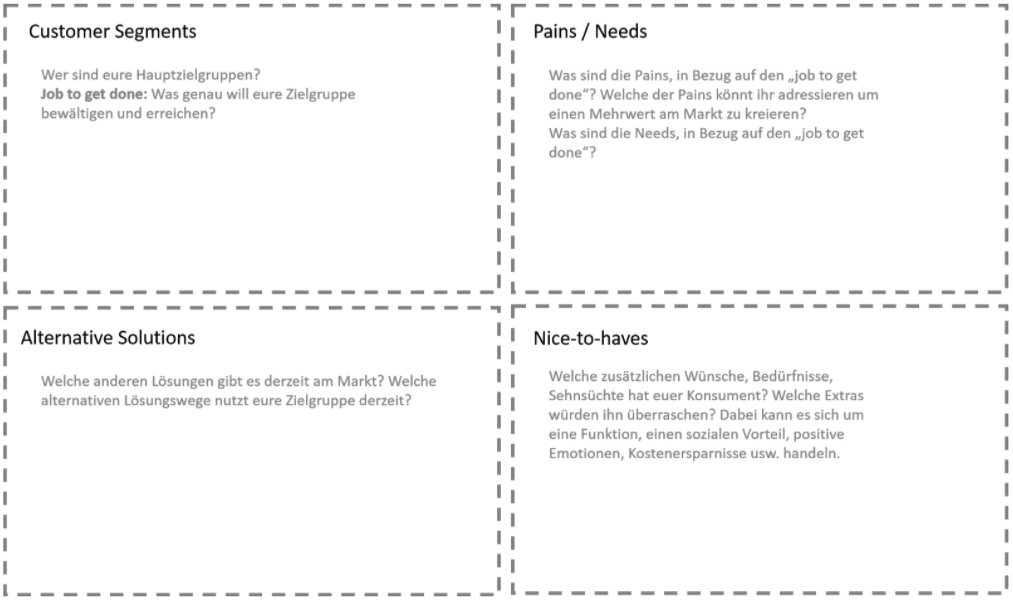

3. Customer Exploration Map

“The more you engage with customers the clearer things become and the easier it is to determine what you should be doing.”

– John Russell

It is often not enough just to know the persona, it is also not enough if the feelings and fears are also known. Simply describing the person does not always lead to the actual problem. And this is exactly where the Customer Exploration Map comes in. With it, the problems and challenges of the customers are explored and also visualized and it helps to find possible solutions for these problems.

4. Formulate hypotheses

A distinction is made between usage hypotheses and growth hypotheses.

Usage hypotheses answer the question of the circumstances under which my product is used, whereas growth hypotheses deal with the question of the circumstances under which customers would recommend my product to others.

These questions can best be answered with the help of interviews or questionnaires. From personal experience I can say that an interview is and will always be my first choice, especially at the beginning. On the one hand, because of the more meaningful, more qualitative results, and on the other hand, the interviewees also represent the “first customers”. Afterwards, they don’t just associate the company with a random brand name, but with something personal, something vivid.

5. Problem/Solution Fit

“Before investing months or years of effort towards building a product, the first step is determining if this product is something worth doing.”

– Ash Maurya

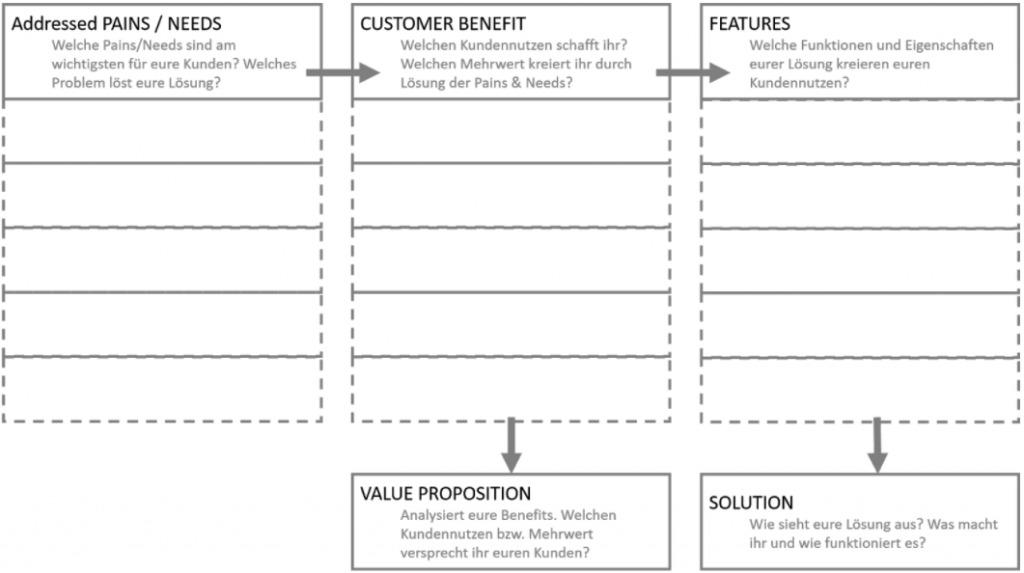

In order to be able to offer the right solution to the buyers, the company must first find the right problem, i.e. the elicitation of the Pains and Needs. A suitable solution must be found for these, what added value is created for the customer by the product and which features are responsible for this. The solution found is then referred to as the Problem/Solution Fit. It is advisable to check this PSF again in advance, i.e. the concept is presented to the target group and they decide whether they would be interested in such a product or not. The company must develop a true game changer for its customers. If the solution is not checked again, there is a risk that a product will be produced that no one actually wants.

Effective Market Research

Compared to the Business Model Canvas, Effective Market Research does not focus directly on target groups, but on the direct experience of your competitors. It is based on sound, data-driven analysis of global competitors.

Here it is not assumed that your own product is unique, especially internationally there will almost certainly already be a similar, if not the same, competing product on the market. But even though my idea is not unique, I can implement it in a unique way, and figuring this out and executing is the goal.

This methodology has become more and more important to me because of my practical experience.

At the software company Vendevio, we also had to differentiate ourselves from several other software companies, with the foreknowledge that we wanted to specialize in start-ups. Through EMR, we then managed to find the seldom exploited potential or even more, the market gaps in already existing software development companies. How do we stand out from the competition and how can we set up vendevio in terms of content? The solution, we act as a software development company but also as a company builder and investor at the same time and thus accompany the entire process, from due diligence, prototyping and MVP to scaling.

We act simultaneously as a software development company, company builder & investor and cover or accompany the entire process, from due diligence, prototyping and MVP to scaling.

1. Define competitors

In the first step, the competitors are defined and divided into groups. The division is made between the local, regional and also the international competitors. Within these groupings, a differentiation is made again, between the closer and the distant competitors. The narrower circle includes those companies whose founding concept or product range are very similar, if not identical, to their own. The wider circle is a term for the competitors who are active in the same industry, but whose products or company policy are not directly related to that of the own company.

2. The right keyword combo

The aim here is to expand the national focus to an international focus. In the keyword combination, terms relevant to the company are searched for in a search engine and the results are compared. Not only the first page is considered here, as we know it from SEO, also not only the first five, but rather the search results of the first fifteen to twenty pages are relevant and must be taken into account. A big advantage is that you can search in several languages at the same time, which increases the number of results. Thus also the international competition is more considered and can be included in the further action. A distinction is made here again between the competitors in the narrower and wider circle/surroundings.

3. Keyword Monitoring

With the help of Google Alerts or Mention, relevant company topics and competitors should be kept in mind in order to always stay up to date. This makes it possible to switch from a static market observation to a dynamic one. This constant market overview provides an important basis for the continuity of the company. Those people who have an overview of the trends and developments are the pioneers of their industry.

4. Competitor Analysis

SimilarWeb or SEMrush are the tools to compare and analyze specific aspects of the apps and websites of the competition. They find commonalities and patterns of the various competitors, i.e. exactly the things that seem to go down well with the target group. Through this comparison, however, not only the overlaps can be identified, but also unused potential can be found in this way, and used to stand out somewhat from the competition.

For example, these tools can be used to determine from which countries the website, app, etc. is accessed the most, or on which social media channels potential customers are best reached.

5. Google Keyword Planner

The Google Keyword Planner provides keyword suggestions that relate specifically to your own company, products or website. Additionally, it is possible to get an approximate estimate of the number of search queries per month for the respective keyword. Thus, one gets an insight into the search behavior of the customers and develops a better understanding of their interests. Another positive aspect is the insight how well the selected keywords fit to the own brand or company.

6. Google Trends

Especially nowadays, when markets and the world in general are changing rapidly, it is difficult to keep track of current trends. The requested data is available almost in real time and can be used to adapt advertising campaigns to the current expectations of the target group. Developments in terms of products and industries can be tracked well and it complements the Google Keyword Planner with the future component. The data from Google Trends cannot be considered 100% true, but the combination of all these steps leads to a more accurate analysis (Google Trends, Keyword Planner, etc.).

In principle, the Business Model Canvas aims to determine, define and understand its target audience. Based on the collected data it should be possible to identify the needs and problems of the customers and to define solutions, as well as to be able to implement them successfully.

In Effective Market Research, competitors are the role models. The basis here is formed by many competitor examples that have been defined beforehand. Their strategies, websites, campaigns and products are used as inspiration and basis for oneself. In the future, this approach will continue to keep an eye on the competition and competition-relevant topics.

Whether it becomes the Business Model Canvas built on Customer Research or the Effective Market Research specialized on competition, a composition of both or a completely modified version only slightly oriented to the originals, the truth is, there is no recipe for success that really works all the time, if there was, I wouldn’t have to write this article. Unfortunately, there is no guarantee that any product or service will eventually meet enough market demand. With enough knowledge and experience, you can reduce the risk of pursuing the “wrong” strategy over time. Marketing and market research are dynamic, it is constantly changing, it is inevitable to always make adjustments and adaptations to the basic strategy.

Authors: Yvonne Maria Göstl & Kambis Kohansal Vajargah

Comments are closed.